What They’re Not Telling You About Qualified Opportunity Funds

One of today’s hottest tax topics is the relatively new concept of “qualified opportunity zones,” created by the Tax Cuts and Jobs Act (TCJA) at the end of 2017. Many are feverishly broadcasting the potential tax benefits of investing in “qualified opportunity funds,” and, indeed, these new provisions are intriguing. Yet, there are several important points that are being overlooked.

The Basics Of QOZs And QOFs

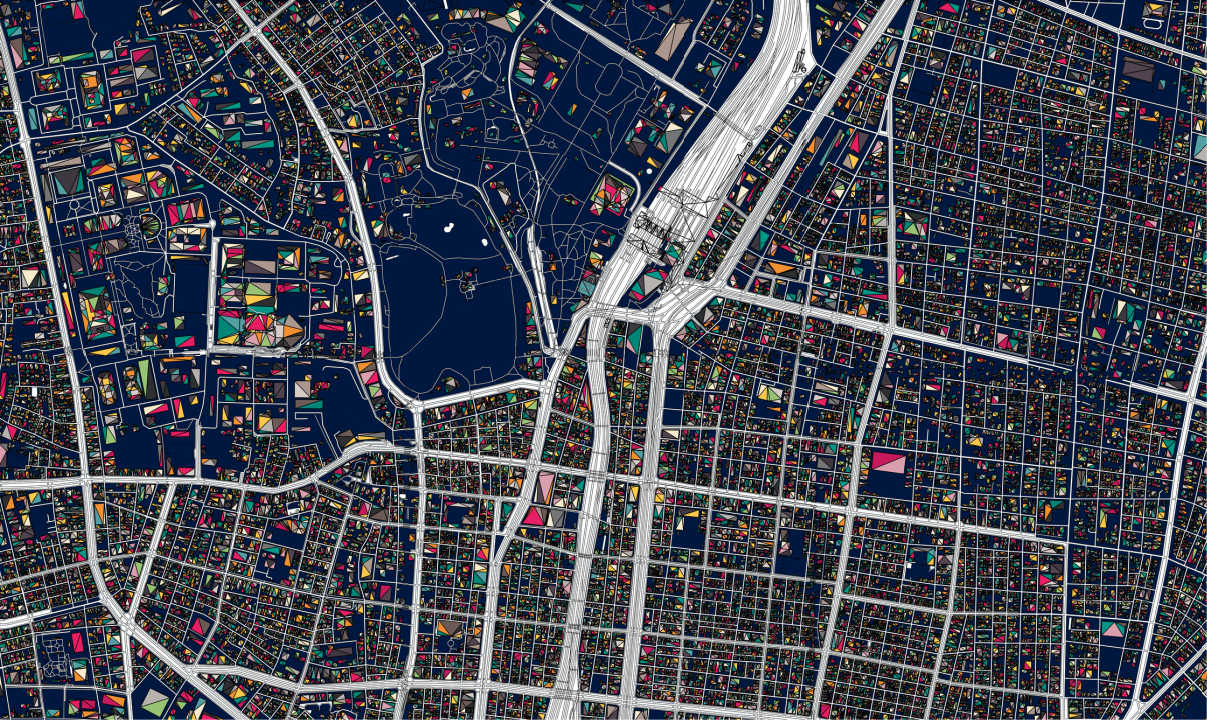

At the risk of oversimplification, we will start with a brief summary of qualified opportunity zones (QOZs) and qualified opportunity funds (QOFs). In short, the concept of a QOZ was introduced as a means to stimulate private investment in economically disadvantaged areas around the country.

The stimulus comes in the form of potentially powerful tax incentives. Generally, an investor who has a taxable gain on an investment can elect to defer all or part of the gain for federal income tax purposes by reinvesting it in a QOF—essentially a partnership or corporation properly set up to make investments within a QOZ—within 180 days of the event triggering the gain. The tax deferral period can last until the earlier of December 31, 2026 or the date on which the QOF investment is sold or exchanged.

The incentive can get even more powerful if the QOF investment is held for at least five years. If it is, then the deferred gain is eligible for a 10 percent reduction through a basis increase. If it’s held for at least seven years, then the deferred gain is eligible for a 15 percent reduction. If the QOF investment is held for at least 10 years, then, in addition to the 15 percent reduction of the deferred gain, the investor also is eligible for a step-up in basis equal to the fair market value of the QOF investment on the date that it is sold. Essentially, this allows the investor to escape taxation on any future appreciation in the QOF investment.

Have you read something like this before? Probably, but here are some things you may not know:

Be Mindful About ‘Letting The Tax Tail Wag The Dog.’

Most importantly, while the benefits of tax deferral and reduction can be quite substantial, keep in mind the potential costs of achieving those benefits. Investing in a relatively illiquid partnership or corporation with the intent of holding the investment for as many as 10 years in order to maximize the available tax benefits requires a strong conviction regarding the merits of the investment itself.

Investing in underserved areas of the country can be seen as a form of impact investing while also offering great economic upside, but it can also carry disproportionate downside risk. It is important to understand and assess this risk alongside the corresponding rewards of tax deferral and reduction. Consider the fact that the government believed that a tax-incentive was necessary to spur these investments because natural market forces were otherwise insufficient to do so. Consider also the fact that QOFs already are becoming a “popular trade,” which is not always the best kind of trade from a long-term perspective, especially if inexperienced promoters seeking to maximize management fees based on short-term demand become involved.

This is not to say that QOFs do not make sense, but they need to be considered in the appropriate—and complete—economic context. Of course, as one considers this deferral opportunity, the fundamentals of sound financial planning should also be applied. Global asset allocation must be revisited, including with respect to real estate and other infrastructure investments; and liquidity needs must be assessed.

Some QOZs Are Not So Underserved And Not So Economically Challenged

Don’t assume that all QOZs are similar from the perspective of their need for investment and revitalization. Already there are QOZs in California, New York, New Jersey, Washington and elsewhere in which personal income, property values and other indicators are higher than might be expected of a QOZ. This reality suggests not only an opportunity but also the need for strong and thorough diligence during the investment process.

Consider The State Tax Implications

All of these tax incentives have been incorporated into the federal income tax, but that does not necessarily mean that they will be available for state income tax purposes (in states that have income taxes). Some states conform generally to federal law for tax purposes, while others conform but only with respect to the federal tax law in effect on a certain date, which may precede the enactment of the TCJA. Still other states offer limited or no conformity to the federal tax law. In any event, investors should not assume that they will receive the same deferral or tax reduction opportunities for state tax purposes. They will need to investigate the state tax laws of their resident state and of the states in which any applicable QOZs are located.

Holding A QOF For 10 Or More Years Can Still Lead To Taxation Under Certain Circumstances

By holding a QOF interest for at least 10 years, the investor can avoid paying federal income tax on any appreciation in the QOF investment. Yet, this does not necessarily mean that the QOF investment will produce no income tax liability for the investor over the course of the holding period. The basis increase earned by the investor for holding the QOF investment for at least 10 years does not happen until the QOF investment is sold. If the QOF sells an appreciated asset held by the QOF during the holding period, then that sale could lead to taxable income for the QOF investors if the QOF is taxed as a pass-through entity.

You’ll Need To Have The Cash Necessary To Pay The Deferred Tax When Due

Remember that the deferral opportunity for QOFs currently is scheduled to end no later than December 31, 2026. If the deferred gain is still invested in the QOF when the tax is due, it may be necessary to allocate other available funds to pay these taxes.

The 180-Day Rollover Period Can Be Longer Than 180 Days

Investors will need to be careful about rolling over their eligible gains into a QOF within 180 days, or they will lose the QOF opportunities afforded by the TCJA. So, if a gain was recognized at the beginning of this year, it’s too late to do a tax-advantaged rollover, right? Not necessarily. If the gain was recognized inside a partnership, then it appears that the 180-day period may not actually begin until the end of the partnership’s taxable year. As stated in recently issued proposed regulations regarding QOFs, “the partner’s 180-day period generally begins on the last day of the partnership’s taxable year, because that is the day on which the partner would be required to recognize the gain if the gain is not deferred.” The proposed regulations also provide that if the partnership decides not to elect deferral of its gain at the partnership level, then the partner may choose to begin the 180-day period when the partnership’s 180-day period begins.

An investment In A QOF Is Not Necessarily a 100 Percent Investment In QOZs

The rules that govern qualifying as a QOF do not require 100 percent investment in QOZs. The rules are somewhat complex, but, in effect, they do allow a QOF to invest significant amounts outside of QOZs. This is important from the perspective of offering some level of diversification and even allowing for potential return-enhancement. In this context, it will be important to understand the strategy and portfolio composition of any QOF. Much as not all QOZs are the same, not all QOFs are the same either.

Qualified Opportunity Funds are an intriguing tax-deferral and reduction opportunity to invest in Qualified Opportunity Zones. The applicable provisions, however, are relatively new, and it is important to proceed with care and caution as investors seek to capitalize on them.