Q1 2023 Colony Market Perspectives

Introduction

Many investors believe that the signal for policymakers to stop hiking interest rates is when “something breaks.” After more than a year of rate increases, something finally broke, and like past episodes, banks were at the epicenter. As a result of high rates causing losses in banks’ securities portfolios and withdrawals by depositors, two banks failed and several others showed signs of distress. The Federal Reserve (Fed), Treasury, and Federal Deposit Insurance Corporation (FDIC) came to the rescue, guaranteeing all deposits of the failed banks, which has so far stemmed further runs.

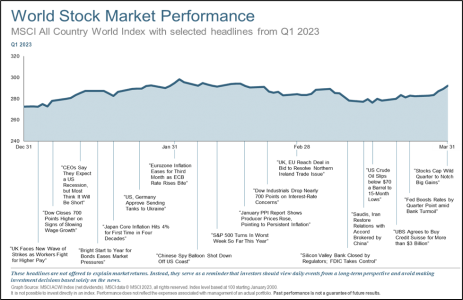

For the most part, investors turned a blind eye to the news, allowing markets to generate positive returns for the first quarter of 2023. U.S. equities, as measured by the S&P 500, returned 7.5%. In a continuation of the trend from the previous quarter, international stocks outperformed domestic stocks, with the MSCI EAFE Index returning 8.5%. Lastly, bonds continued to build on last year’s fourth-quarter positive performance with a return of 3.0%.

Problems in the banking system have caused investors to worry about the safety of what they thought were low risk investments. They also have led to new questions about the outlook for the remainder of the year. We tackle both concerns in this quarter’s letter.

Cash Crunch

In a flashback to the Great Financial Crisis of 2008-2009 (GFC), investors are again being forced to reconsider where they stash their cash. The collapse of Silicon Valley Bank (SVB) surprised not only depositors and investors but also its overseers. Despite several banking crises since the end of World War II, regulators still have not found a way to prevent these events from recurring. Nevertheless, their interventions have reduced near-term solvency concerns, although bank earnings may remain under pressure for some time (Regional Banks: Battered, But Not Beaten).

The bank failures that have occurred this year – Silvergate, SVB, and Signature Bank of NY – were largely distinctive in nature. Silvergate was a cryptocurrency bank that closed voluntarily because of turmoil within those markets. SVB’s focus on the venture capital ecosystem illustrates that the importance of diversification extends beyond the investing arena. Indeed, the rapid rise in interest rates last year slowed venture-backed dealmaking and is restraining growth for many venture-backed companies. What started as a decline in deposits due to withdrawals from these now cash-starved companies devolved into a run on the bank, from which SVB could not recover. Subsequently, nervous depositors were quick to pull their money from any bank that they feared might be at risk. This caused Signature to fail and left a couple of other banks fighting for their survival.

Today’s turmoil is very different from what occurred during the GFC. In 2008, banks were much more leveraged and were sitting on trillions of dollars of impaired loans. Compared to today, banks have much stronger balance sheets and generally hold more secure loan portfolios. The assets they own that have declined in value are mostly relatively safe fixed-income securities, such as government bonds and agency mortgages, which have been marked lower due to rising interest rates. Unfortunately, our fractional reserve banking system is exposed to runs on the bank; however, regulators have the means and methods for dealing with these types of liquidity issues.

Therefore, we remain comfortable with bank deposits. For additional protection, we believe it is prudent to diversify deposits above the general FDIC insurance limits of $250,000 per depositor, per insured bank, for each account ownership category. We recommend using an aggregator that seamlessly allocates cash across (often) higher-yielding banks to keep each account below $250,000. Certificates of Deposit (CDs) are another good option but are subject to the same FDIC limits as savings accounts and have liquidity constraints. Please speak with your advisor to learn more about these and other options.

What this means? – There may be even better options for cash outside of the banking system. U.S. government bonds with maturities of less than one year, such as Treasury Bills, currently offer yields greater than 4.5%, are typically perceived to be risk-free from default, and carry less interest-rate risk due to their short durations.

Money market funds now offer competitive yields too, but investors should take care to select the right ones. Money market funds typically fall within one of three broad categories: taxable, tax-free, and prime. Most taxable money market funds yield around 4.2% and invest in government or agency bonds that are issued by government-sponsored enterprises such as Fannie Mae (FNMA) or Ginnie Mae (GNMA). Tax-free money markets primarily invest in municipal bonds that are exempt from federal taxes and sometimes state taxes. They are currently yielding approximately 3.5%, or 5.5% on a tax-equivalent basis for investors in the highest federal tax bracket. Lastly, prime money markets offer the highest yields, currently about 4.4%, but carry more risk than the others. Prime money markets mostly invest in commercial paper, which is short-term debt issued by corporations. As such, they have higher default and liquidity risk than other money market funds.

As of today, most signs point to a benign outcome for the banking sector. Depositors should feel confident that their savings are safe, especially for amounts underneath the FDIC insurance limits. Nevertheless, there are easily accessible alternatives available that should help nervous depositors to sleep better at night.

Soothsaying: Stocks vs. Bonds

Markets tend to reflect the collective wisdom of their participants’ outlook for the future. As such, they generally do a better job than individuals at forecasting. Often there is uniformity in what different markets, such as the stock and bond markets, are foreshadowing. Sometimes they diverge, however, which implies a higher degree of uncertainty.

For most of the first quarter, it appeared that stock and bond market investors disagreed over the outlook for inflation. The Consumer Price Index (CPI) did not come down as quickly as many investors had hoped at the beginning of the year, causing the Fed to forcefully reiterate its commitment to squash inflation. This caused bonds to sell off in February, pushing the 10-year Treasury yield back over 4% and near its October highs. Stocks, on the other hand, have continued to march higher, rising above the bear market lows from October, suggesting that investors were not overly concerned about inflation and rising yields.

The banking crisis may have pushed the stock and bond markets’ inflation outlook into alignment. Banks are now more likely to curtail lending to protect their balance sheets. Less credit availability should provide a headwind to both consumer spending (due to fewer auto loans and mortgages) and business spending (due to fewer commercial and industrial loans), helping to keep a lid on inflation. As a result, bonds have rallied, pushing 10-year Treasury yields to approximately 3.25%. Additionally, after a brief decline over concerns about the stability of the banking sector, stocks rose, reflecting most investors’ expectations that inflation will finally decelerate meaningfully.

What are the markets telling us about growth over the remainder of the year? Here the alignment is a little less obvious. Rising bond prices and the corresponding decline in yields may suggest that growth will slow more than previously expected. Indeed, for the last nine months short-maturity bonds have been outyielding long-maturity bonds, which is uncommon. This so-called inverted yield curve has historically been a reliable harbinger of a recession. Contrarily, stocks continue to push higher, signaling that the stock market may not share the bond market’s view that a recession is coming. The performance of certain sectors, however, do support the thesis that growth may decelerate over the coming quarters. For instance, growth stocks have materially outperformed value stocks this year. Typically, value does well during economic expansions while growth does relatively better during periods of slower growth.

What this means? – The collapse of SVB may eventually be viewed as a seminal event for the investment markets. The Fed has struggled to contain inflation, and the problems in the banking sector may offer some assistance as banks rein in lending. The stock and bond markets appear to agree that inflation should recede more sustainably, which would ultimately be a positive tailwind for investment markets.

Slowing inflation may come at a price, however. The Fed has been clear that, by raising interest rates, it hopes to prevent the economy from overheating. Their efforts thus far have been less effective than planned. Tightening lending standards by the banks may be enough to help the Fed slow growth. The challenge is not to allow growth to slow too much.

Last year’s bear market may already have telegraphed this year’s growth slowdown; however, if the Fed’s interest-rate hand is too heavy, stocks could still have more downside. Nevertheless, almost every prognosticator has raised the possibility of recession in the next year or so, and thus it would take a severe downturn to surprise the markets and cause significant additional losses.

Conclusion

Despite the turmoil in the banking sector, the financial markets have thus far proved resilient. We do not currently foresee the types of systemic risk that occurred during the GFC. That said, we are mindful of the role that confidence plays and acknowledge the risk of further bank runs, though policymakers’ implicit backing of uninsured deposits should prevent that from happening.

As we said above, the banking crisis may prove to be a seminal event that helps risk assets continue to move higher. Perhaps banks will now do some of the Fed’s work for them by curbing the creation of credit and, therefore, slowing growth. This may help to slow inflation to the Fed’s target of 2%.

This does increase the risk of a recession, but it does not guarantee that one will occur. Most believe that the Fed may do one more rate hike of 25 basis points and then pause. It is also possible that March was the last hike of the cycle. What is unclear is when the Fed might start cutting interest rates. If it becomes apparent that the economy is slowing more than the Fed is targeting, they will likely slash rates, which would help offset any decline in earnings.

In previous letters, we discussed the elevated level of uncertainty in most investors’ outlooks. Ironically, the banking crisis may have made the picture a little clearer. Investors are slowly refocusing their concerns towards growth and away from inflation as a deceleration in inflation becomes more probable. There are always uncertainties with investing, but a dose of clarity, however small, is always welcome.

Sources: BCA Research, Morningstar, and Alpine Macro