Investing with Values: Q3 2022

![]()

The Inflation Reduction Act (the “IRA” or the “Act”) of 2022, or H.R. 5376, became law on August 16th, 2022. The bill represents the largest-ever single federal investment in fighting climate change and has been praised by some for its embrace of both foundational and emerging technologies, its scope and flexibility, and, importantly, the long-term visibility it provides.

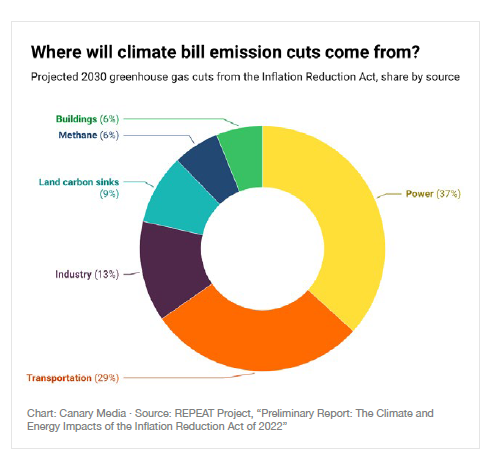

According to the Congressional Budget Office (CBO), the IRA includes $386 billion of climate and energy spending tax incentives. From an emissions perspective, Moody’s Analytics estimates the Act will reduce carbon dioxide emissions nearly 30% by 2050.1

![]()

While going into all the details of the IRA is beyond the scope of this discussion, we highlight what we believe are the key aspects and what they may mean for investors, businesses, consumers, and the environment.

The Act provides a significant boost for foundational clean energy technologies. The IRA includes a 10-year extension of the Production Tax Credit (PTC) and Investment Tax Credit (ITC) programs that have been the bedrock of wind and solar power growth. For the first time, solar projects will be allowed to access the PTC, potentially increasing their profitability over time. Additionally, the Act includes incentives for investment in energy efficient buildings, nuclear energy, carbon capture, and a new tax credit for biogas generation that may benefit the waste sector.

In addition to extensions of existing spending programs, the legislation could provide a meaningful boost to vital, innovative technologies that may have been held back due to lack of policy support. For example, the energy storage industry will now have access to the PTC for stand-alone energy storage investments. Energy storage technology is a key component of integrating variable wind and solar power into the grid. Other emerging technologies covered in the Act include clean hydrogen, carbon capture storage, and demand response. Over the long-term, these incentives should reduce the green premium, or the additional cost from choosing a clean technology over one that emits more greenhouse gases.

For businesses, the Act provides $10 billion in investment tax credits to build clean technology manufacturing in the United States. This should accelerate U.S. manufacturing of solar panels, wind turbines, batteries, and critical minerals processing. Additionally, the IRA includes provisions for up to $20 billion in loans to build new clean vehicle manufacturing facilities across the nation. There also are grant and loan programs to promote a transition to clean electricity for states and electric utilities. We believe these incentives should have the added benefit of increasing manufacturing jobs as companies, both incumbent and new, seek skilled workers to accelerate the energy transition.

Consumers can also benefit. The IRA offers tax credits up to $7,500 for new electric vehicles and $4,000 for used ones. While there are some restrictions included in the language that limit eligibility to vehicles assembled in North America, the credits should promote and accelerate the transition to lower emissions vehicles. Additionally, consumers will benefit from tax credits to make homes more efficient by making heat pumps, rooftop solar, electric HVAC, and water heaters more affordable.

Perhaps the most significant tailwind from the IRA is the visibility it provides for clean energy investments over the next decade. We see this sentiment echoed by sustainable investing community. Previously, both the structure and duration of tax credits and incentives didn’t allow for strategic, long-term planning. That changes with the IRA. Ecofin Advisors believes “This is a green light to deploy capital that was on hold” and we may see “an unprecedented level of investment in the sector over the next decade.”2

We believe the IRA is a significant development in the energy transition and should accelerate innovation, increase adoption, and encourage more investment to decarbonize the US economy. We also believe the Act may provide long-term opportunities for financial return and impact in several of the investment themes we have discussed in past issues.

2 Ecofin Editorial: Inflation Reduction Act, September 12, 2022, Brent Newcomb

3 Certain public companies as well as certain funds of managers listed above may be held in Colony’s Sustainable Investing Solutions strategies. These are included for reasons unrelated to performance, past or future; rather, we want to showcase what we believe are some of their positive contributions in the sustainable investing space. There is no assurance that any listed security or fund manager will have exposure within Colony’s strategies in the future. Inclusion herein is not recommendation to buy or hold any security and no attempt is made to suggest that holding any security will be profitable to an investor.

For more on Sustainable Investing Solutions, read our Sustainable Investing Primer or our article in Worth magazine.