Fed Pauses, Oil Doesn’t

The September Federal Reserve meeting delivered the pause in rate hikes that markets were expecting, but with a twist, as Chairman Powell suggested they may keep rates higher for longer. Growth has been stronger than most expected, the labor market has moderated but not cracked, and inflation has trended lower providing the Fed with reasons for optimism. However, this may prove too good to be true. Economic soft landings are rare, and a too-strong economy before the plane has landed runs the risk of inflation reigniting. While we believe that core inflation is likely to continue to trend toward the Fed’s 2% target, rising energy costs may cause consumers to question whether the Fed’s campaign is working.

What About Energy Inflation?

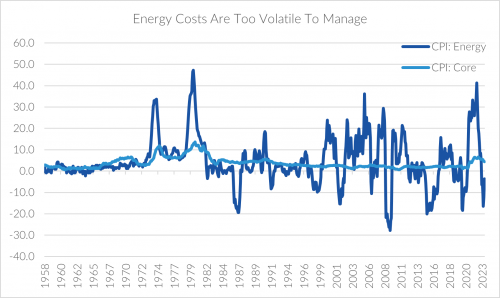

The Fed has historically downplayed the influence of energy prices on inflation for good reason. Energy is one of the most volatile components of price inflation. While year-over-year core inflation has stayed within a range of 0.6% to 13.6% since 1958, the energy component has experienced far more dramatic swings between -27.8% and 47.2%. Between June 2022 and June 2023 alone, year-over-year energy costs rocketed up 41% before nosediving 16%. The price of oil, perhaps the most important driver of energy costs, is often affected by factors like geopolitical conflicts and hurricanes, which are well outside the Fed’s control.

Source: Bureau of Labor Statistics

While core inflation (which excludes food and energy prices) rose just 0.3% in August, the cost of energy commodities, including gasoline, rose 10.5%. Arguably, the rise of hybrid work schedules, more efficient vehicles, and higher wages should reduce the importance of gas prices on households. Nevertheless, having to pay $4.00 per gallon for gas (almost $6.00 per gallon in California) has a powerful psychological effect on consumers.

Energy Pricing vs. Policy Goals

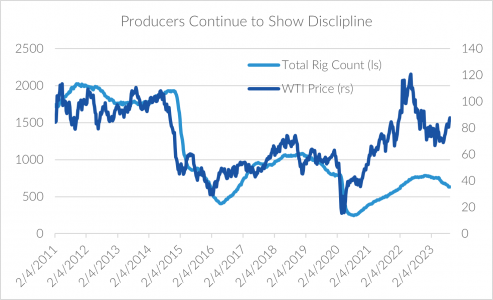

Unfortunately, there’s reason to think that higher energy prices may persist. Energy producers continue to show remarkable discipline. Historically, the industry has been subject to volatile boom and bust cycles, ramping up capacity rapidly as oil prices rose and cutting sharply on declines. This cycle, however, their response has been far more measured. Perhaps learning from their past mistakes, that the death of high prices is too much production, or the realization that political winds can shift quickly against the fossil fuel industry, producers have opted to prioritize returning capital to investors over developing new oil fields.

Source: Baker Hughes, U.S. Energy Information Administration

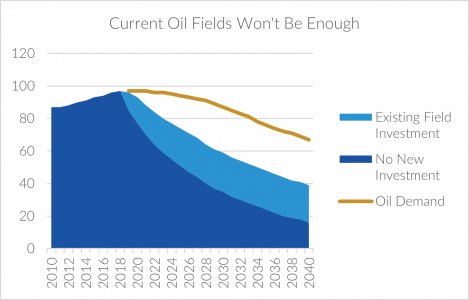

This puts policymakers in an unfortunate situation. While most countries have prioritized developing renewable resources, the traditional energy sector has faced a decade of underinvestment. Indeed, new oil fields are still required despite recent reports suggesting that the world will hit “peak oil demand” within the decade. The energy transition will likely be bumpy, and investors and consumers must prepare by building portfolios that reflect current and future energy needs.

Source: IEA

What Does This Mean?

We continue to believe that the recent pause is an example of the Fed calibrating its interest rate policy to the current environment rather than playing catch-up (Hop, Skip, and a Jump.) In our view, this provides investors an opportunity to gradually de-risk portfolios by diversifying into fixed income, where they can lock in higher yields for longer. We also believe it’s essential to maintain an “all of the above” approach to energy investing by investing in tomorrow’s renewable infrastructure while not ignoring the opportunity in the traditional energy sector.