Hop, Skip, and a Jump?

The Fed did something noteworthy at its June 2023 meeting by doing nothing. After raising rates at each of its previous ten meetings, the committee determined that a wait-and-see approach was the best path forward. Last year, the Fed fell behind in its fight with inflation requiring outsized 50-75 basis point hikes at first followed by a slowdown to smaller 25 basis point hops in the first half of 2023.

This month’s pause in rate increases came with a large caveat: the Fed made clear that it reserves the right to restart increases as needed. Indeed, most FOMC members forecast an additional 50 basis points of hikes through the end of 2023 before easing in 2024. All of this is consistent with our thesis that the Fed has shifted from “catch-up” to “calibration.”

Inflation Data

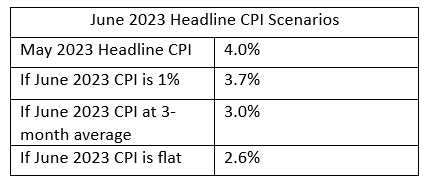

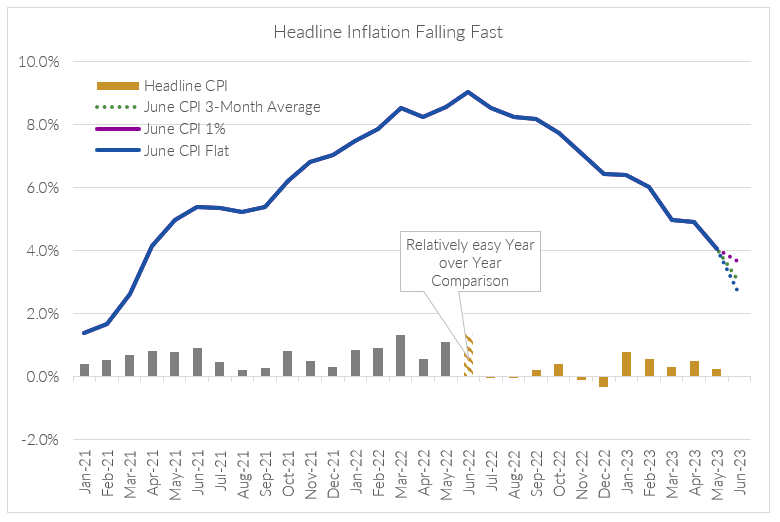

There are reasons for optimism that the Fed may be done. History shows that headline inflation generally falls about as fast as it rose. Inflation growth peaked at greater than 9% year-over-year in June 2022. As of last month, it has declined to 4%. The number will likely take another significant leg downward next month. Even a 1% rise in monthly prices for the month of June, a much higher pace than what has been reported over the past several months, would result in a year-over-year increase of 3.7%, as June 2022’s 1.4% price increase rolls out of the twelve-month window.

More opportunistic scenarios could see headline inflation fall much further.

Additional progress will be harder to achieve in July, however. Last year, prices remained relatively subdued throughout the summer, making for tougher comparison year-over-year. In our view, it’s likely that any relief in inflation in June may be offset with upticks in July and August.

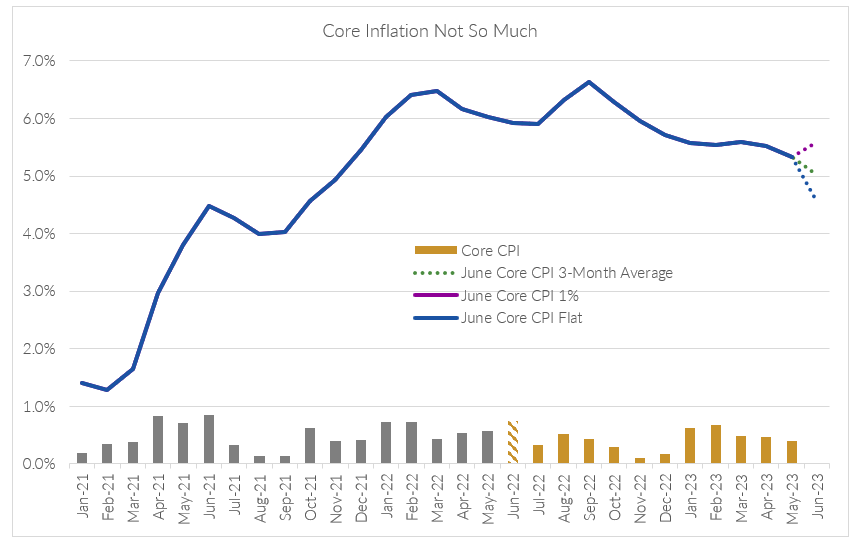

Nevertheless, while headline inflation may provide optimism for a Fed pivot, core inflation (the Fed’s preferred metric, which strips out food and energy) is proving to be stickier. Rising shelter prices continue to push core inflation higher. While other measures of rental prices have decelerated markedly over the last 12 months, the official numbers still reflect prior year’s robust rent increases. Until the government data shows a similar slowing, it seems unlikely that core inflation can fall below 4% in the near future.

The Broader Economy

The Fed considers more than just inflation when deciding on policy. On the surface, recent employment reports suggest that the labor market remains strong; however, declines in the number of weekly hours worked and a rise in the unemployment rate indicate that cracks are forming. Moreover, measures of manufacturing activity suggest a contraction and activity in the services sector is decelerating. Finally, the impact of this spring’s banking crisis are still largely unknown. With six weeks until the next meeting, the Fed will have plenty of fresh data to guide them.

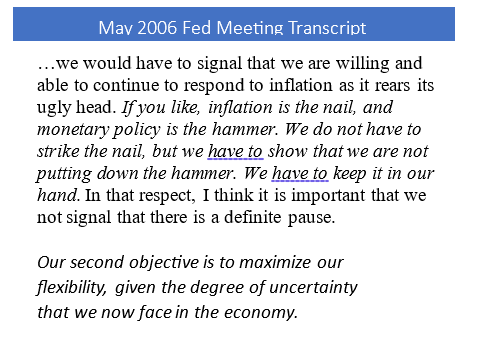

The Power of Fed Speak

Students of Fed history will recall that they have used hawkish language during previous rate pauses as a tool to keep markets in check. In 2006, at the end of a previous hiking cycle, then-Chairman Bernanke likened inflation to a nail and Fed policy as the hammer. He argued that it was important to make sure markets knew that the Fed still has the hammer in its hand if needed, as they endeavored to balance suppressing inflation against supporting growth in future decisions.

What Does This Mean?

There is likely to be a lot of speculation regarding the Fed’s future policy actions over the coming months. In our view, any consternation may be misplaced. Subsequent moves in the Fed Funds rate are unlikely to be as impactful as the previous 500 basis points of rate increases that are still working its way through the economy. Additional actions are likely meant to reinforce confidence that the Fed is being proactive rather than reactive. One positive from all of this is that fixed income investors should enjoy higher yields for at least a little while longer.