Year-End Tax Planning 2023

With a divided Congress and the 2024 elections on the horizon, it is unlikely that we will see any major federal tax legislation in the immediate future. In turn, the approaching sunset of many individual tax provisions of the Tax Cuts and Jobs Act of 2017 (“TCJA”) looms large. Should Congress fail to act, the highest individual and trust tax brackets will increase to 39.6%; the standard deduction will be cut roughly in half; and the lifetime estate and gift exemption will be reduced from nearly $13 million to an estimated $6 million in 2026. And while any imminent federal tax changes are unlikely, the end of 2022 did bring us SECURE 2.0, an Act that made many “quality-of-life” changes to retirement planning while also creating a bit of confusion around inherited IRAs. As 2023 winds down, it feels like the calm before the storm from a tax perspective. This makes it the optimal time to revisit tax and estate planning strategies.

Plan for the Future

While year-end tax planning is often focused on immediate savings, it is important to keep in mind the potential impact of long-term strategies. With the lifetime estate and gift exemption set to be cut approximately in half after 2025, it is more important than ever to have an estate plan in place. In 2012, the last time the exemption was set to decrease significantly, estate planning attorneys were overwhelmed. Being proactive about setting up an estate plan, rather than waiting until the 2025 rush, will provide you enough time to come up with a plan to meet your goals. For some, that will mean setting up a spousal lifetime access trust for their family, while for others it may mean setting up a charitable remainder trust to support their favorite charities in a tax-advantageous way. Here are some other longer-term strategies to be aware of:

- Provide for future generations: The annual gift exclusion amount increased to $17,000 per person in 2023 and is set to increase again to $18,000 in 2024. A married couple can therefore gift $34,000 this year to as many individuals as they want without using any of their lifetime gift exclusion. Keep in mind that medical expenses and tuition payments made directly to an institution on behalf of family members do not count against the lifetime exemption.

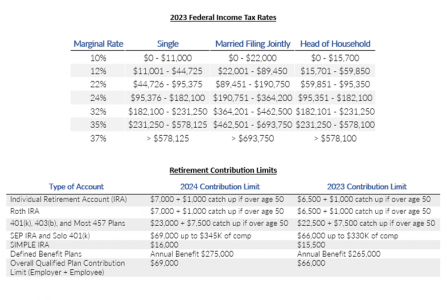

- Plan for retirement: Taxpayers with traditional IRAs should consider whether it makes sense to convert them into Roth IRAs before the lower individual tax rates sunset in 2026. If converted into Roth IRAs, the funds in question receive the double benefit of growing tax-free and not triggering taxes upon distribution at a later date.

- Save money for education: Contributing to a 529 plan is a good way to let your college savings grow tax-free. If the funds are used for qualified education expenses, there will be no tax when withdrawn. These plans are even more flexible now that $10,000 per year can be used to pay for K-12 tuition. Be aware that not every state has conformed with the federal rules, however, so a K-12 distribution may still be taxable at the state level.

- Donate to the causes you care about: Contributing to charity can be an effective way to lower your tax bill while helping your community, but many taxpayers will have trouble eclipsing the standard-deduction threshold. One strategy to get over the threshold is to bunch multiple years’ worth of contributions into one year. Setting up a donor advised fund is a great way to accomplish this bunching strategy while still controlling the timing of the charitable contributions.

Secure Your Retirement Plans

On December 29, 2022, the SECURE 2.0 Act was signed into law, resulting in several significant retirement planning changes. Some of these changes have provided new opportunities, while others have generated new questions.

- Some things get better with age: One helpful change is that the beginning RMD age was raised from 70.5 to age 72, and beginning in 2023, the age was raised from 72 to 73. Beginning in 2033, the RMD age will be raised again from 73 to 75.

- But I thought stretching was good for me: The rules for RMDs from inherited IRAs saw sweeping changes, including the elimination of the “stretch IRA” for most non-spouse/child beneficiaries. Inherited IRA distribution rules now depend on whether the original owner was subject to the RMD regime prior to death and if the new owner is an eligible designated beneficiary. The IRS has still not issued final guidance for non-eligible beneficiaries affected by the new rules.

- Wave penalties goodbye: The IRS provided a gift to taxpayers and waived penalties for certain late/missed RMDs, including 2023 RMDs taken before September 30, 2023. The 50% penalty for missed RMDs has been reduced to 25% and will be further reduced to 10% if the missed RMD is taken within two years. Historically, the IRS has been quick to waive these penalties if there was reasonable cause for the missed distribution. It will be interesting to see if these waivers are harder to come by now that the penalties are less severe.

- Never too late to catch up: SECURE 2.0 also brings about some changes beginning in 2024. Roth 401(k) plans will not be subject to the RMD regime, a welcomed change. 401(k) plans will also allow for the option to make catch-up contributions to a Roth 401(k) where this option was previously only available as a traditional 401(k) contribution. Beginning in 2026, high earners will only be able to make catch-up contributions to a Roth 401(k). Employer matching contributions are also allowed to be made to either a traditional or Roth 401(k). Finally, beginning in 2025, individuals reaching certain ages will have higher catch-up contribution limits.

- From ABCs to IRAs: Beginning in 2024, families will be able to roll over unused 529 plan funds to a Roth IRA for each beneficiary. While this is subject to annual IRA contribution limits and cannot exceed a lifetime maximum of $35,000 per beneficiary, it can be a useful future planning opportunity for families looking to jump-start the retirement savings journey for their children and grandchildren.

Remember that State Tax Planning Matters Too

While focusing on federal tax changes is important for effective year-end tax planning, there are also profound year-end planning considerations at the state level.

- The Massachusetts Millionaire’s Tax and revival of the charitable deduction: The new Massachusetts Millionaire’s Tax, which is a 4% surtax on taxpayers earning more than $1 million per year, began in 2023, and there are some planning tips we have for Massachusetts resident, part-year, and nonresident taxpayers. For 2023 only, taxpayers may file their Massachusetts tax returns separately, allowing for a $1 million limitation for each taxpayer. Beginning in 2024, this option will no longer be available. Also, after a long hiatus, the charitable contribution deduction is back for Massachusetts taxpayers. Cash and stock donations will now be allowed to offset “Part B Income,” which is any non-portfolio type income such as wages and business income. Taxpayers with substantial income of this type will need to do a year-end tax projection because charitable donations may result in up to 9% in Massachusetts tax savings on top of the federal tax savings. See our article here covering the Massachusetts charitable deduction in greater detail: https://news.bloombergtax.com/tax-insights-and-commentary/massachusetts-charitable-tax-deduction-brings-a-big-opportunity.

- Opportunity for Business Owners: The pass-through-entity tax deduction is still available, and many of our partnership and S-Corp clients are taking advantage of this workaround for the current federal $10,000 cap on itemized deductions for state income and property taxes. Thirty-six states now have their own “PTET regime,” and a few have proposed bills in the works.

It is of course important to remember that each taxpayer’s circumstances are different. You should therefore contact your wealth or tax advisor to develop an appropriate plan tailored to your individual situation.