Why Is Inflation so Low?

Editors Note: This analysis is being published in collaboration with EconoFact, a nonpartisan economic publication that created the following content.

The Issue:

Inflation has averaged just over 1-1/2 percent over the past decade, well below the Federal Reserve’s target of 2 percent. Such low inflation for such an extended stretch is quite unusual given historical economic relationships. With the current unemployment rate near historic lows, the persistent soft readings on inflation pose a puzzle and challenge for economists, financial market participants, policymakers, and the general public who must make decisions based on what they expect inflation to be in the future. Accordingly, much attention has been focused recently on trying to understand why inflation has been so low in recent years.

The Facts:

- The traditional short-run tradeoff between inflation and economic activity suggests that, over horizons of a few years, low unemployment will boost inflation and that high unemployment will lower inflation, with other factors—such as changes in energy prices—also mattering in certain time periods. This relationship is known as the Phillips curve (named after A.W. Phillips, who discovered the relationship in the 1950s). The notion behind the relationship is basic supply and demand. When economic activity and demand are high relative to the economy’s capacity to produce goods and services (supply), the attendant pressure on resources will tend to drive up wages and prices. This relationship has generally borne out historically: over a period of two or three years, inflation has exhibited a tradeoff with measures of economic resource utilization, with higher resource utilization (reflected, for example, in a low unemployment rate) associated with rising inflation. Most economists believe that over longer spans of time monetary factors are key to the behavior of inflation (see here).

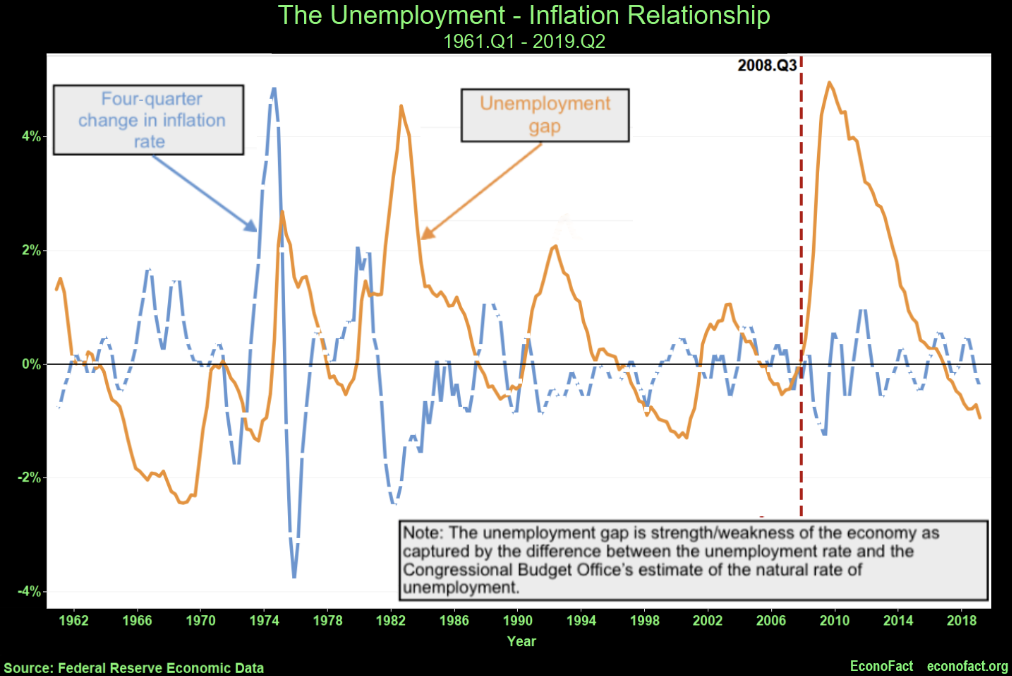

- Since the financial crisis, the relationship between the strength of the economy and inflation trends has differed from previous patterns. These patterns are highlighted in the chart: the orange line plots the unemployment gap (a measure of resource utilization based on the unemployment rate) while the dashed blue line shows how much inflation was rising or falling. Prior to the mid-2000s, a large unemployment gap indicating a weak economy was associated with falling inflation (dashed blue line less than zero). When the unemployment gap was negative and the economy was strong, inflation tended to be rising. However, since the financial crisis, the behavior of inflation has not followed this pattern. Inflation did not fall as much as might have been expected in 2009 and 2010 (when the economy was very weak) and, since then, it has persistently been lower than might have been expected given the strength of the economy and the attendant decline in the unemployment rate below the natural rate of unemployment (as seen in the chart with the unemployment gap dipping negative).

- There have been other periods in the past when the expected relationship between inflation and the strength of the economy did not hold, which caused economists to question and revise the Phillips relationship, adding more factors into consideration. In spite of this, the Phillips curve has — until recently — served as a good rough guide for monetary policy. During the 1960s while inflation was fairly low, the relationship Phillips identified worked rather well in explaining the behavior of inflation. The tradeoff seemed to break down in the 1970s as so-called “stagflation” took hold with high unemployment and double-digit inflation in the wake of large increases in the price of oil. This breakdown led economists to focus more on the role of factors other than the unemployment rate (like energy prices) and to be more careful about the tradeoff disappearing in the long run. Although many academic economists were challenging the Phillips relationship in the 1970s, Federal Reserve Chair Paul Volcker relied on it in the late 1970s and early 1980s to bring inflation back down; that is, he raised interest rates dramatically to cause a major recession and substantial increase in the unemployment rate. As predicted by the Phillips relationship, inflation did, in time, come down dramatically. In the 1990s, the idea of this short-run tradeoff between inflation and unemployment continued to be widely used in policy circles and did a reasonable job of tracking inflation behavior. (For instance, documents prepared for the policy-making arm of the Federal Reserve System make clear that a relationship between inflation and resource utilization played an important role in the setting of monetary policy during this period).

- So what explains the low inflation since the Great Recession? Economists have identified several possible factors that could have made inflation more stable recently and less responsive to the unemployment rate or that could be holding inflation down.

- Anchored inflation expectations could be making inflation more stable and less susceptible to factors that previously would have pushed inflation up or down. In particular, expectations of future inflation may have become more anchored, or pinned down. Actual inflation has been quite stable in recent decades, and, in 2012, the Federal Reserve publicly stated for the first time that its target for inflation is 2 percent. In turn, with more stable inflation expectations, factors that might push inflation up —such as a low unemployment rate or a jump in as a energy prices — would have less effect on actual inflation than in the past because everyone expects inflation to return fairly quickly to the Fed’s 2 percent goal (see here for further discussion of these issues).

- Globalization may be restraining inflation. In recent decades, on-going globalization has significantly increased linkages between countries. According to this story, greater trade in goods and services as well as tighter connections across financial markets around the world imply that U.S. inflation may no longer be determined largely by domestic factors. For example, global resource utilization may now play a role in determining U.S. inflation, diminishing the role of resource utilization in the United States. If this story is right, then the apparent misses of Phillips curves based on U.S. variables reflects, at least in part, the frequent omission of global variables in analyses of U.S. inflation (see here). Another factor that likely affected U.S. inflation was the entry of China into the World Trade Organization, and the rapid expansion of Chinese exports to the United States. This transition, however, likely had a one-off effect as consumers and businesses switched from domestically-produced to foreign-produced products.

- Technology also could be holding down inflation. The spread of the Internet has changed patterns of commerce for millions of consumers and businesses, providing greater price transparency and more competition for local businesses thereby limiting price increases (see here).

- Changes in labor markets are another factor that might be curbing inflation. The spread of global supply chains, declining unionization, a fall in the real minimum wage, and shifts in social norms around pay may have reduced the ability of employees to bargain effectively for higher wages, thereby limiting inflationary pressures coming from tight labor markets (see here).

- Changes in government policy or the methodology for measuring inflation also could be factors. Changes in government policy that are unrelated to the state of the economy, such as changes mandated by the Affordable Care Act, could be keeping inflation in check. And, changes in the methodology for measuring inflation also can hold down inflation. For example, the introduction of a new price index for cell phones in 2019 by the Bureau of Economic Analysis reduced inflation in consumer goods retrospectively and likely prospectively as well (see here).

- Some evidence supports each explanation. Of course, determining causality is extremely difficult and, as is often the case with complex changes in economic relationships, several of these factors may have simultaneously played a role. Moreover, although the bulk of research suggests that the relationship between resource utilization and inflation has weakened in the past couple of decades, that research does not typically suggest that the relationship has vanished completely. Indeed, Hooper, Mishkin, and Sufi (2019) evaluated a wide range of data to assess price and wage behavior, including U.S. aggregate data to gauge variation over time and state- and city-level data to investigate relationships at the sub-national level. All told, they find support for a Phillips-curve type association between resource utilization and inflation, and they conclude that “reports of the death of the Phillips curve may be greatly exaggerated.”

What this Means:

The evolution of inflation is relevant for all economic actors. However, for policymakers at the Federal Reserve, understanding the sources low inflation is of paramount importance. If the low inflation reflects persistent factors that will restrain inflation for an extended period of time, then the Federal Reserve could reasonably set interest rates at lower levels and would need to be highly attentive to the possibility of declining inflation (particularly in the event of a recession). On the other hand, if the low recent inflation reflects transitory factors that begin to abate and the economy remains reasonably strong, then the Federal Reserve likely would need to set interest rates at higher levels as the usual relationship between unemployment and inflation again becomes evident. Mistakes could be costly, leading either to inflation that falls further below the Federal Reserve’s target or inflation that rises too far above, in which case the Federal Reserve likely would raise rates significantly (possibly enough to cause a recession). Although much interesting economic research has shed light on recent inflation behavior, the Federal Reserve will have to make decisions with imperfect information about these issues.