Why Focusing on the Long-Term is Smart Investing

Following the 2020 Covid-19 market crash and the 2022 inflation related market fall, equity investors can be forgiven for feeling a certain amount of apprehension regarding recent positive returns their portfolios have experienced. Most investors seem predisposed to focus on potential negative short-term outcomes rather than the broader overall positive long-term trends. It just seems to be human nature that a certain part of our brain is always waiting for the other shoe to drop.

These feelings of impending disaster are reinforced by our inability to escape the 24-hour news cycle. Unfortunately, one of the lessons that some commentators and networks seemed to learn in the aftermath of the 2008 crash was that money and fame is available to those who predict the next apocalypse. You only need one correct call to be hailed as the next talented prognosticator, and the bigger and bolder your prediction is, the more airtime and internet clicks you likely will receive.

Whether the source of these feelings of unease is real or imagined, managing the accompanying emotions can be challenging for investors. It is important for investors to understand that every market crash is unique in terms of its cause, the market reaction and recovery times. Usually, in times of financial turmoil in the equity markets, investors are able to seek cover in fixed income investments that tend to fare better when equity returns fall; however, however, 2022 was especially traumatic for investors with the pullback in the equity markets accompanied by one of the worst performances in bond market history. With equities and bonds both on a downward trend, investors had no sign of relief.

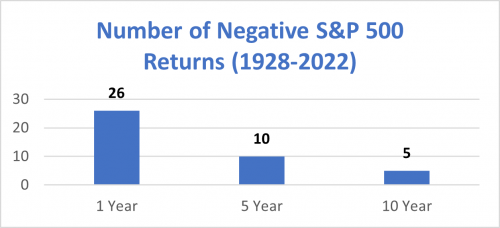

A look back at investment returns since the Great Depression illustrates the potential benefits of focusing on longer-term returns. The following chart shows the historical number of negative returns of the S&P 500 over single-year and rolling five- and ten-year periods. As demonstrated in the chart below, longer time periods exhibit a significantly lower frequency of negative returns.

During this 95-year period, an investor in the S&P 500 had about a 27% chance of experiencing a negative return in any given calendar year; however, over longer holding periods, the probability of a loss declined quite dramatically. For instance, over any five-year period, the probability of loss was more than halved, as investors experienced a loss only about 10.5% of the time. Increasing the investment period to ten years, the probability of a loss declined even further to just 6%. It is worth pointing out that each of the ten-year periods that experienced a negative return included either the Great Depression or the combined drawdowns experienced by the popping of both the 2000 dot-com bubble and the 2008 housing bubble, demonstrating just how catastrophic an event must be to generate negative returns over a ten-year period.

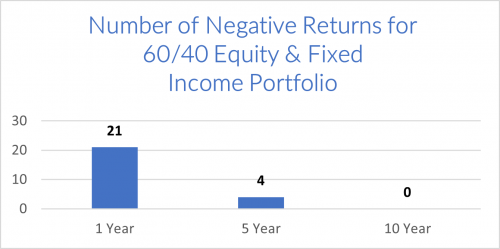

Of course, investors generally are not investing exclusively in the S&P 500. Rather, they typically own diversified portfolios of equities, fixed income, and other asset classes. While most asset classes do not have the long-term historical data available like the S&P 500, such data does exist for some fixed-income investments. Using returns for the U.S. 10-year Treasury Bond as a proxy for a fixed income allocation, we can build a 60% Equity/40% Fixed Income balanced portfolio and compare this to the returns of the equity-only portfolio.

As one might expect, diversifying into fixed income could further decrease the amount of negative calendar year returns an investor would have experienced since the Great Depression. Indeed, there were no ten-year periods in which an investor would have experienced a negative return. Furthermore, the likelihood of any individual calendar year return being negative declined from 27% to 22%.

Another way to explain how diversification reduces the overall risk of a portfolio is by focusing on correlation. Correlation is a statistical measure of the relationship between two securities in a portfolio. It helps to explain how securities in a portfolio will move relative to each other during different market and economic conditions. A portfolio containing securities that have a low, zero or negative correlation to each other should limit losses when values fall in one asset, as they should fall less or even rise in another.

While we must always remember the investment adage “past performance is no indication of future results,” the return information presented above hopefully lends some credence to the potential benefits of investing in a diversified portfolio of assets over a long-term time horizon. A properly diversified portfolio is designed to smooth the path for investors to help them meet their personal long-term goals. Of course, every individual year presents a unique set of investment challenges. Nevertheless, we believe that investors that are able keep their focus on long-term growth will continue to prosper in the future.