What’s Next for Real Estate?

In November, we described how the real economy might soon begin to reflect some of the weakness experienced by the financial markets throughout 2022. One of the early places to see this dynamic may be the real estate market. For most consumers, housing represents their largest expense and often their most significant investment. As we move through the economic cycle, heightened uncertainty tends to slow housing growth. As with the broader real economy, our long-term outlook remains constructive for high-quality real estate, but we could see weakness in the coming months.

From late 2020 through early 2022, residential real estate was one of the hottest markets around. Following the initial stages of the pandemic, household formation boomed. After being cooped up in tight quarters for months, adult children finally began to fly the nest, and divorce rates rose significantly. Moreover, those households that remained intact desired more space – many either upgraded their primary residence or added a second home. Real estate agents showed potential buyers listings via FaceTime, and transactions closed rapidly – many times for cash and often without inspections or other contingencies.

When the Fed took notice of the broader inflation environment (including real estate), it acted quickly. In less than a year, the Fed’s hawkish policies drove mortgage rates to levels not seen since before the Great Financial Crisis. For months, home builders have observed an uptick in cancellations. Consequently, they’ve slowed the pace of new home starts from 1.8 million units in April 2022 to 1.4 million units in October. Estimates suggest that based on the number of new builds and the slowing pace of sales, there are nine months of new home inventory on the market today. While new home trends tend to lead the broader real estate market, existing home sales have also slowed. The median price of a house continues to rise but at much more reasonable rates.

If, as we suggested last month, Main Street’s pain is yet to come, many might wonder what that means for real estate. Publicly traded real estate companies are certainly feeling Wall Street’s worries. Through November, the Vanguard Real Estate ETF (ticker: VNQ) is down 22.3% year-to-date, surpassing the decline seen in broader equity markets. Counterintuitively, these declines are happening despite still relatively strong fundamentals. Indeed, according to FactSet, through the third quarter, the S&P 500’s real estate sector reported the second-highest earnings growth of all 11 sectors at 18.7%.

Real Estate Crisis?

Given this relative strength, recent stock price declines must reflect diminished hopes for the future. In general, we find this budding skepticism to be warranted. Higher interest rates make home ownership less affordable for buyers needing mortgages, suggesting a slowdown in demand is likely. In addition, would-be sellers are growing more reluctant to list, fearing higher mortgage rates on their replacement homes. This potential demand slowdown comes after two years of developers rushing to build additional units to fill a supply shortage that was years in the making. As these units come online and supply and demand reach equilibrium, the meteoric rent and home price increases will slow.

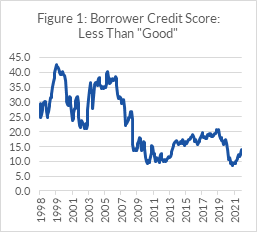

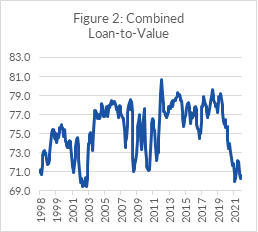

Does a slowdown mean a 2008-like crash in real estate is coming? At this point, we believe that is unlikely. The Great Financial Crisis (GFC) was caused by over-levered borrowers with too little equity and rising payments. Borrowers are much more creditworthy today (Figure 1). In the years leading up to the GFC, 35-40% of borrowers had credit scores ranked below “Good.” On the contrary, through 2021, that number remained below 15%. Furthermore, borrowers have much more skin in the game, with loan-to-value ratios near historic lows (Figure 2.)

Source: Federal Housing Finance Agency

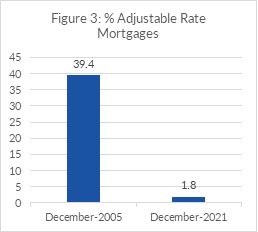

Mortgage holders are less likely to be subject to rising rates. Where adjustable rate mortgages (ARMs) represented more than 40% of residential real estate debt in the mid-2000s, it represented less than 5% of the market (Figure 3) through 2021. While there has been an uptick in ARMs this year, this is likely due to borrowers anticipating rates to come back down. Nevertheless, the rates on these ARMs typically do not reset for five years, limiting the risk of ballooning payments in the near term.

Source: Federal Housing Finance Agency

Location, Location, Location!

While we’ve thus far focused on the national market, we recognize there are significant differences across regions. Urban and suburban centers in the Sunbelt states continue to show relative strength. Conversely, the ubiquity of remote work and greater geographic mobility suggests that high-tax and high-cost-of-living states may see greater headwinds moving forward.

Our Outlook

We believe that the real estate market is more likely to slow than crash. There is an unusually high dispersion across pricing forecasts for housing next year. Nevertheless, even the more pessimistic views by mainstream economists are less dour than public equity market moves imply.

Strong fundamentals support this thesis. Indeed, given homeowners’ higher equity and lower mortgage payments, sellers have little pressure to accept low-ball offers. Additionally, the rental market remains robust, allowing sellers to convert their primary residences to rental properties.

In our opinion, over the short term, real estate markets are more likely to be characterized by shallow activity rather than rapidly declining prices. As always, property type, location, and asset management expertise will be vital to maintaining high, inflation-linked income streams. Long-term, we believe investors who can accept some amount of illiquidity from diversified private real estate will be at an advantage.