The Impact and Potential of Women Investors: The Evolution of Women and Wealth

According to the U.S. Bureau of Labor Statistics, the workforce participation rate for women is 57.4%; meanwhile, roughly 59% are living paycheck to paycheck. But why?

There are several contributors:

- Access. A historic lack of access to financial education and resources has affected the ability of many women to adequately secure their financial futures including college savings, retirement savings, and social security.

- Gender Pay Gaps. Working women earn 80% of that of their male counterparts.1

- Childcare and Eldercare Responsibilities. Her Wealth by Colony’s Financial Life Cycles Series addresses the fact that women in the workforce are often juggling a lot not just professionally, but personally as well. In many cases, in addition to maintaining a full-time job, women are simultaneously balancing the challenges of caregiving – whether childcare or eldercare – often in single income households. Accordingly, they are far more likely to report childcare and/or eldercare challenges as hindering their careers, including being forced to lessen work hours (e.g., full-time to part-time), passing on promotions or professional development opportunities, taking a leave of absence, retiring earlier than planned, or leaving their job altogether.

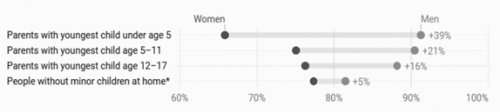

Having children lowers women’s employment participation rates, with those with younger children experiencing a larger impact

Employment-to-population ratio for women and men, by parental status and age of youngest child if applicable, December 2022

*This category includes adults ages 25-54 who may be parents of grown children or who may never have had children.

Source: Authors’ analysis is based on Sarah Flood and others, “Integrated Public Use Microdata Series, Current Population Survey: Version 9.0 (dataset)” (Minneapolis: University of Minnesota, 2021), available at http://doi.org/10.18128/D030.V9.0. Chart: Center for American progress.

The effect(s) of these challenges on women’s financial well-being.

There are many ways these personal responsibilities can directly influence a woman’s career and long-term earning potential including: compromised benefits, less probable access to a 401k plan, reduction of social security payout (as much as $131,000),2 and perhaps most damaging, lower retirement assets. Beyond this, there is an all too common and unfortunate need to dip into long-term savings vehicles such as 401(k) plans – particularly when it comes to eldercare – to support these caregiving needs, further depleting retirement funds.

More than 20% of women caregivers have recently claimed an inability to adequately budget and save for retirement due to these responsibilities, 20-30% being Millennial or Gen X women. This is particularly alarming considering the Centers for Disease Control and Prevention reports women’s average life expectancy to be 79 years old – nearly five years longer than their male counterparts. To effectively prepare for the entirety of such an expected lifespan, it is anticipated that women will need an average of $165,000 for health care-related expenses alone throughout retirement; an amount many may be unaware of or feel unprepared for.

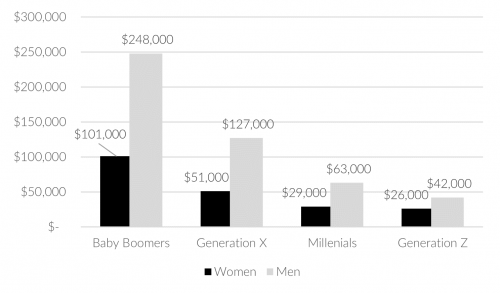

2023 Median Retirement Savings by Gender

Source: Transamerica Center for Retirement Studies

Boomers = Ages 59-77; Gen X = Ages 43-58; Millennials = Ages 27- 42; Gen Z = Ages 18-26.

Women are taking control of their financial futures.

With the Covid-19 pandemic suspected to be one of the largest catalysts for women taking charge of their finances in recent years, women are demonstrating all-around financial wellness reflected in claims of less debt, improved credit, ample emergency savings, and all generations representing larger populations of women investors.

For example, research by Fidelity Investments concluded that 51% of women began investing assets since the start of the pandemic and 42% plan to continue. This shift has been reflected in retirement savings as well with roughly 68% of women saving for retirement since 2019 versus only 66% five years ago.

Fidelity customer records also indicated women capitalizing on various savings vehicles like Health Savings Accounts (HSAs), more so than their male counterparts, with HSA account opens by women having grown 204% since 2019 versus 172% by men, and asset growth among women having increased by 334% versus 309% by men.

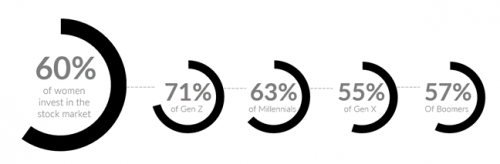

Led by the women of Gen Z, and as shown below, when it comes to the stock market, 60% of women are currently invested.

Source: Fidelity Investments.

Women are thinking differently about investing.

As discussed, while women are less likely to dabble in investing then men, when they do, they are incredibly effective investors; often outperforming their male counterparts by as much as 40 basis points.3 Why, you ask? Women think differently when it comes to investing; both in how and where they put their money to work. Statistically, women investors are known to be more risk-averse; take more time evaluating investments before moving forward; naturally hold portfolios with greater diversity; are less active and naturally patient in times of market volatility; approach investing with a long-term view; and place a great degree of importance on value, sustainable investing, and philanthropic giving. In fact, 61% of women ages 30 to 40 select their investments based on their potential social or environmental impact4 and 71% make investment selections with sustainability in mind compared to 58% of men.5

Women are looking to put their money to work in meaningful ways.

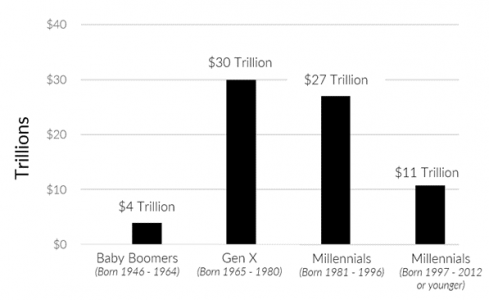

Wikipedia defines The Great Wealth Transfer as, “an intergenerational wealth transfer that is underway in the United States, among other nations, with the baby boomer generation leaving significant wealth to their heirs. Baby boomers and the silent generation will bequest a total of $84.4 trillion in assets through to 2045, with $72.6 trillion going directly to heirs. The transfer of wealth from baby boomers will account for $53 trillion or 63% of all transfers, while the Silent Generation will hand down $15.8 trillion.” Of this transfer, women are expected to inherit at least $30 trillion in assets.

By the Numbers: The Great Wealth Transfer

By Generation: Estimated Wealth to Be Inherited through 2045

Source: Cerulli Associates, “The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2021.”

Sources:

2 https://www.investopedia.com/retirement-savings-by-gender-5100948

4 https://andsimple.co/insights/women-in-impact-investing/

6 https://www.charitableimpact.com/blog/do-women-or-men-give-more-charitably/