The Fed is Chaperoning the Party, Not Shutting It Down

It’s a time-honored tradition for kids to throw parties when their parents leave town. In August, they got their chance, as the Federal Reserve (the Fed) had a break in its calendar, and traders enjoyed the waning weeks of summer at the beach, creating a light month of news and trading. Indeed, broader equity markets started the month strong, and meme stocks returned to prominence, analogous to a racous party. Reports of a deceleration in inflation for July lulled some market participants into believing that the Fed might pivot away from rate hikes, allowing the party continue. In an unusually brief speech from Jackson Hole, however, Fed Chairman Jerome Powell abruptly put an end to the party.

In just eight short minutes, Powell gave the most hawkish speech of his career. He spoke of restrictive policy, the unfortunate costs of fighting inflation, and the need for forceful action. By mentioning Paul Volker, the most feared, inflation-fighting central banker in history, he caused market participants to attempt a rapid clean up before the adults return. Fellow Fed officials piled on by reiterating Powell’s stern warnings, adding to investors’ consternation.

We do not dismiss the Fed’s resolve to defeat inflation. Nevertheless, we are uncertain that they will need to increase rates as much as they currently project. There was a certain irony to the timing of Powell’s speech. Just 90 minutes earlier, the Bureau of Economic Analysis reported that July’s Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred measure of inflation, was well below both recent history and expectations. While one month certainly does not constitute a trend, leading indicators suggest that inflation continued to soften in August.

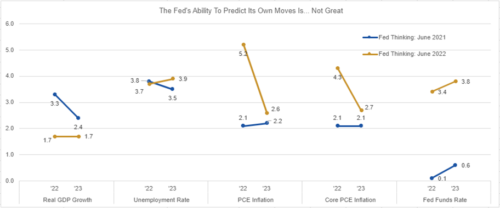

With all due respect, we question the Fed’s ability to forecast their own policy actions.

Source: Federal Reserve, Table 1 Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents

In June of 2021, FOMC members released their 2022 and 2023 expectations for the Fed Funds rate. At that time, they forecasted 0.1% and 0.6%, respectively. Today, the committee has set the target rate at 2.25%-2.50%, and recently forecasted it will reach 3.4% by the end of this year and 3.6% by the end of 2023. The latest Fed rhetoric suggests that their targets may increase when they meet at the end of September. Certainly, the last couple of years has been an extraordinarily difficult for economic forecasting. As such, it is understandable that many investors are not taking the Fed’s words at face value.

It is unwise to underestimate the impact that the Fed’s communications and policy actions may have on the financial markets. However, we believe there is sometimes a disconnect between what the Fed says and what their true motivations and objectives are.

The Fed has a dual mandate: maximum employment and price stability. Recently, the two seem to be at odds. COVID has caused shortages for both labor and goods, leading to wage and price increases. Compounding the issue, higher wages and tight labor conditions pulled forward demand for goods before supply chains could catch up. Many commentators suggest that the Fed wants to (or must) force higher unemployment to solve the inflation problem. Not only would that run counter to the Fed’s dual mandate, but it would also be uncharacteristic for Powell, who two years ago discussed the issue of income inequality in America and the Fed’s role in solving it.

For now, the Fed remains in a difficult position. While its policies seem to be having the desired impact, declaring victory too soon risks unwinding its recent success. On the other hand, additional aggressive tightening risks violating its employment mandate. Thus, we anticipate that the Fed will continue its role as the adult in the room using its tough words to keep the party from getting out of hand, but only interdicting if the action calls for it.