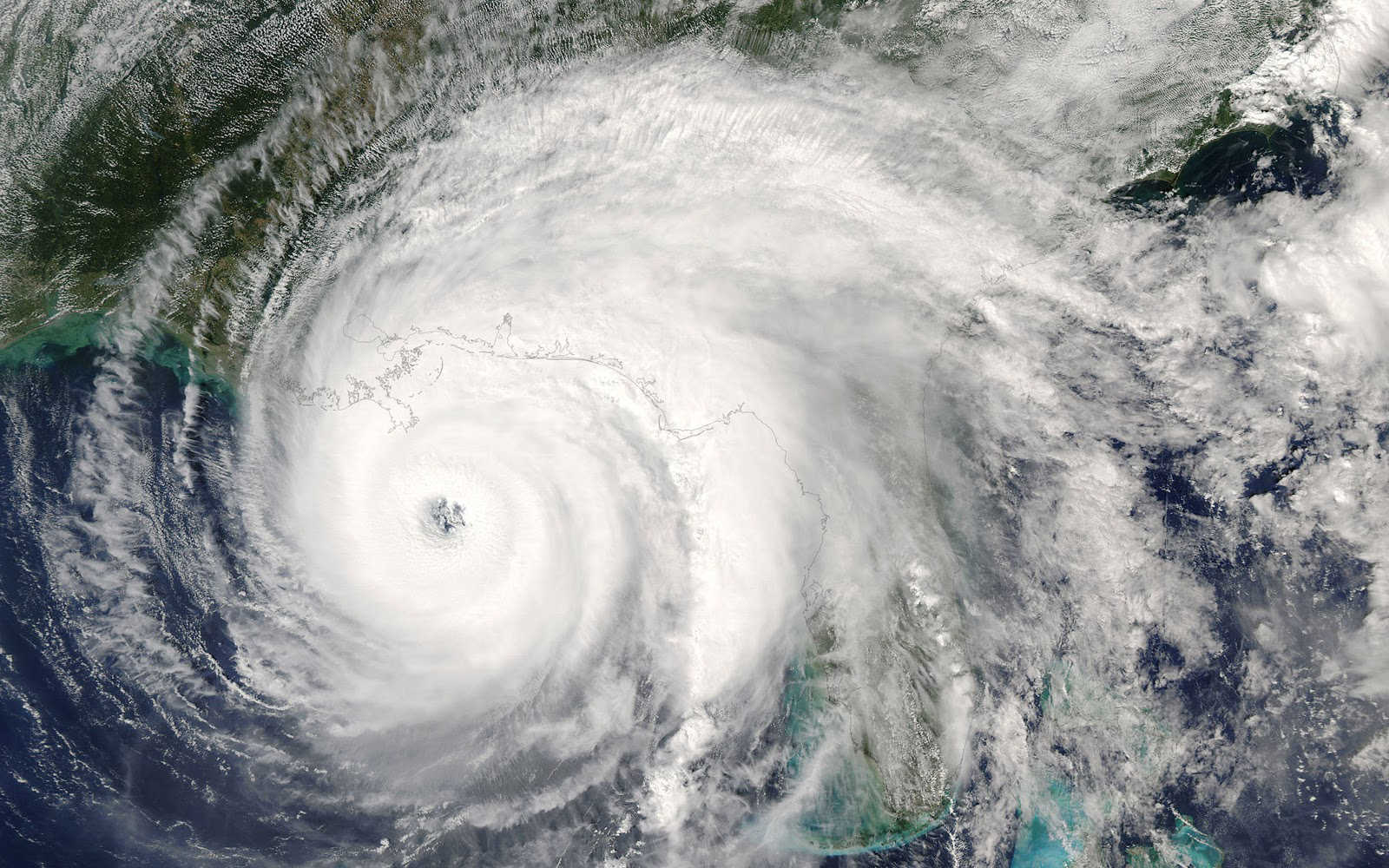

The Eye of the Storm

One of the most dangerous phases of a hurricane comes as the first half of the storm passes and the eye of the storm is overhead. The winds calm down, the sun comes out, and people are tempted to go outside into the clear of day. Over the last several weeks, as we went through the first hit of the COVID-19 storm, we counseled clients to seek shelter in diversification.

The sun seemingly came out last week as poor economic data was offset by more positive developments regarding the virus’s spread.

- Unemployment claims continued to mount last week with an additional 6.6 million of new claims filed on top of 7.5 million workers filing continuing claims. Certainly, many states’ systems have become overloaded and some individuals requiring assistance have not been able to get it. Nevertheless, the number of households currently receiving assistance is encouraging.

- Evidence is emerging that the US is nearing a peak in new COVID-19 cases and deaths. Generally, Americans have taken the shelter-in-place warnings more seriously than officials anticipated, which has helped to further flatten the curve. One explanation is that the experts’ models anticipated only a 50% compliance rate with social distancing policies, but data suggests that compliance has been much higher. The focus now shifts from “flattening the curve” to “keeping it flat.”

- The Fed, who many investors worry has “run out of bullets,” followed through with more stimulus this week. The Fed and Treasury announced details of its Main Street Lending Program and plans to inject another $2.3 trillion from its balance sheet that includes purchases of lower-rated bonds. This will also support states and municipalities through the purchase of municipal bonds. In our view, this enhances the odds that as businesses go through a liquidity crisis, it shouldn’t devolve into widespread solvency issues.

The next few weeks may be more challenging. Companies are starting to announce first-quarter earnings along with guidance for future quarters. It goes without saying, that the forward guidance will generally not be good (if it is offered at all). Also, while we expect a peak in COVID-19 cases, we should be prepared for flare-ups if individuals are less compliant to the containment efforts. While the optimists in us are pleased that we are passing through the first part of the storm, our realistic side understands that the situation is still fluid.

For now, we continue to advise investors to keep sheltering-in-place, both for the sake of their health and to meet their long-term financial goals.