Smart Saving Strategies for Millennials from a Millennial

I fall into the group of young adults who are best known (so far) for racking up the largest student debt in history. This is not exactly how we want to be remembered, but our generation still has time for the history books to record more illustrious achievements.

Perhaps this is why we need to be even better money managers and savers than our parents or grandparents, but when you don’t have a lot of extra money each month, where should you begin? Before I give you a few suggestions of where to find money to save, let’s look at the compelling reasons why you should start saving early.

Pennies count

One of my favorite people in history is Benjamin Franklin who pointed out that a penny saved is like a penny earned. What he means is that if you spend money now, you have to earn that money all over again. If you choose to save that penny today, you can exponentially increase your wealth in the future.

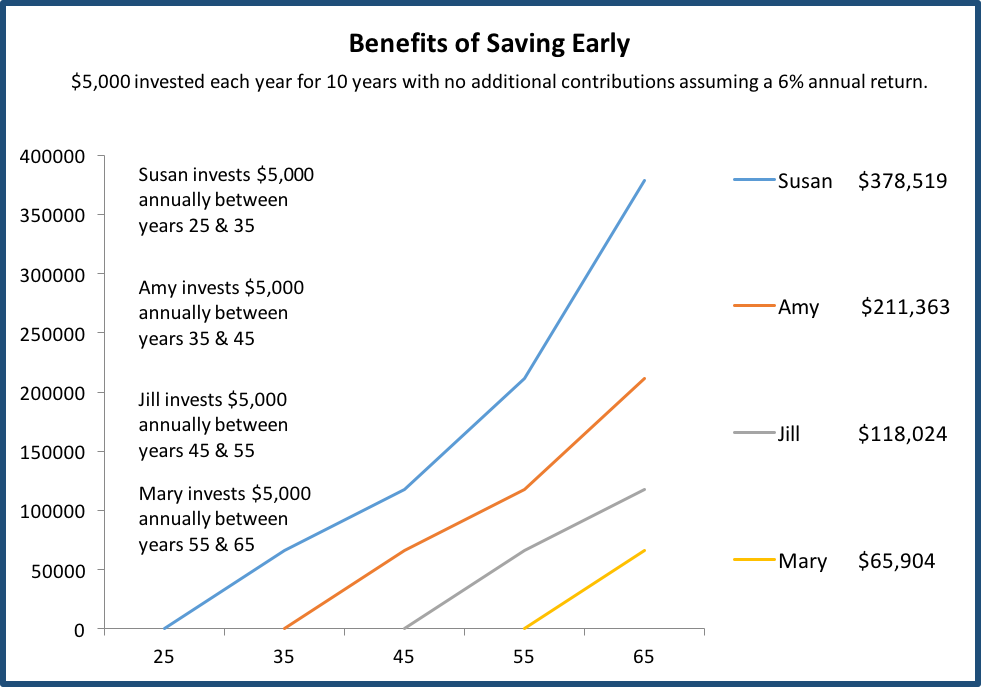

Here’s an example of how that works. The chart below shows four women who all save $5,000 a year for ten years (for a total investment of $50,000 each) earning an annual 6% return. Susan starts to invest at age 25 and has $378,519 when she retires at age 65. Mary, on the other hand, decided that retirement was off in the distant future and she would worry about saving later. She didn’t start saving until she was 55 years old. When she retires at age 65, she will have only $65,904 saved.

The most important takeaway is this—they put aside the same amount of money. The difference in the amount of money each of them will have when they retire is entirely due to the extra 10, 20 or 30 years of compounding interest.

Now that you understand why you should start to save when you’re in your 20s and 30s, let’s go find some money to deploy to savings.

Convert fees to savings

We are so used to paying $.99 for an iTunes download or $1.99 for a new app, that we’re just not aware of the fees that we pay to banks. What’s a few dollars here and there for an AMT charge to get cash, or an overdraft fee if we forget to move money to cover our debit card purchase? Well, it’s big money for the banks—to the tune of $5.1 billion according to an analysis by SNL Financial and CNN. That’s how much American’s three largest banks made in overdraft fees in 2014.

With that in mind, a big way to save money without giving up any of your disposable income is to stop paying bank fees. You should never pay a bank fee just to have an account with a bank. Most banks offer ways to open a savings or checking account with no fees and will waive their account fees if you set up a monthly direct deposit into the account. If you are using a debit card, check your account regularly to make sure that you have sufficient funds so that you don’t get charged an overdraft or insufficient funds fee.

Lastly, avoid paying ATM fees. Here’s one of the best suggestions I have heard of to get cash when you’re not near your bank – use the cash back option offered at grocery stores and pharmacies. I have a coworker who will go to a pharmacy and buy something that she already needs like shampoo or a pack of gum, then use the cash back option to get the cash she needs and avoid ATM fees.

Interest payments could be earning interest for you instead

According to NerdWallet, the average American household pays $6,658 per year in interest on their debt. Interest on credit card debt—the most expensive debt— accounts for almost 40% of this interest. The best way to avoid incurring interest payments is to simply pay your bills on time and live within your means.

While this is easier said than done, especially when money is tight and buying on credit seems to be an easy solution, the benefits of developing this discipline have far-reaching effects. Paying off your monthly balances and paying on time will help you to build a good credit score which can help you to secure a lower mortgage interest rate when you want to buy a home. Paying less interest on a loan of 30 years will leave you with more money in your pocket to save, invest and earn interest for you.

Take advantage of free money

Most employers offer some type of match when you save a portion of your salary in their 401k or other company-sponsored retirement account. This is free money—an annual bonus without the review!

Let’s say you make $60,000 a year and your company agrees to match 100% of your contribution up to 3% of your salary. If you contribute $150 per month which works out to be $1,800 per year, your company will also contribute $1,800 to your retirement account. Where else can you earn 100% on your investment without taking any risk?

Just by taking the money you are already spending on unnecessary fees and credit card interest, you could fund your 401k and get the free money your employer is handing out.

If we start to make these small and smart changes in our 20s and 30s and use the advantage of time while we have it, those pennies will become big savings.