Self-Inflicted Wounds

The most frustrating crises are those borne of our own actions. This is why we believe the risk of a default by the United States of America is among the most pestiferous. The emerging crisis has been widely anticipated and there are a range of obvious solutions. While both Democrats and Republicans have legitimate grievances with the process of raising the debt ceiling, we attribute some of the current deadlock to grandstanding. No matter how the next few weeks of political shenanigans unfold, we’re confident that neither side will come out of this unblemished.

Why Are We Talking About This Now?

On Monday, May 2, Treasury Secretary Janet Yellen informed the House of Representatives that, without an increase in the debt ceiling, the Treasury believes it will not be able to meet all its obligations after June 1, much sooner than prior estimates. The Treasury needed to pull forward its target date due to a 30% year-over-year decline in its April 15 tax collections.

While the timeline has been accelerated, it does not explain why Congress and the White House, which have known about these issues for some time, have not yet engaged in negotiations. Unfortunately, that time was squandered, and many are wondering if there is still enough time or desire to prevent a default.

As advisors, we generally believe the best advice is to remain invested and maintain diversification. Holding through market turmoil has historically worked out well for investors. Despite world wars, the Cold War, pandemics, and asset price bubbles (to name a few), markets have continued to trend upwards over longer periods of time. Investors often only remember the risks that materialized and forget the countless others that caused anxiety but were never realized. Frankly, when investors attempt to trade around every threat, they become more like speculators than investors.

We are not trying to minimize this particular risk. A full default by the United States of America would be damaging to the financial markets. Simply consider that for the last 50 years, U.S. Treasuries have been considered the “risk-free asset” on which all other investments are compared. As the most liquid security in the world, they are the backbone of the global banking and financial systems. While we believe that the likelihood of a total default is low, a perceived increase in this risk alone may bring unintended consequences.

History of the Debt Ceiling

Many might wonder how it came to be that the decision to raise the nation’s debt limit was decoupled from decisions regarding the budget. It’s a reasonable question as most households and businesses make those sorts of decisions in tandem. But alas, the legislative process is rarely reasonable. Recognizing that politicians tended to vote in favor of spending but against debt, Congress implemented the Gephardt Rule in 1979, which deemed any increase in spending would automatically increase the debt ceiling. While this link between spending and debt made sense, it created a situation where politicians were unaccountable for the consequences of their spending decisions. Unsurprisingly, the national debt soared during this time. In 1995, Congress repealed the Gephardt Rule to force a separate discussion on the country’s level of indebtedness.

In 2011, tensions involving the debt ceiling reached an all-time high. While Congress eventually found a compromise and did the right thing (after exhausting all the wrong things first), a major rating agency decided that the degree of political dysfunction had reached a point that the U.S. no longer warranted the highest credit rating of AAA. After the last 12 years of subsequent brinksmanship (and in 2023, it looks as bad as ever!), it is hard to argue they were wrong. It would also be hard to fault other agencies for following suit in the future.

Potential Paths to Resolutions

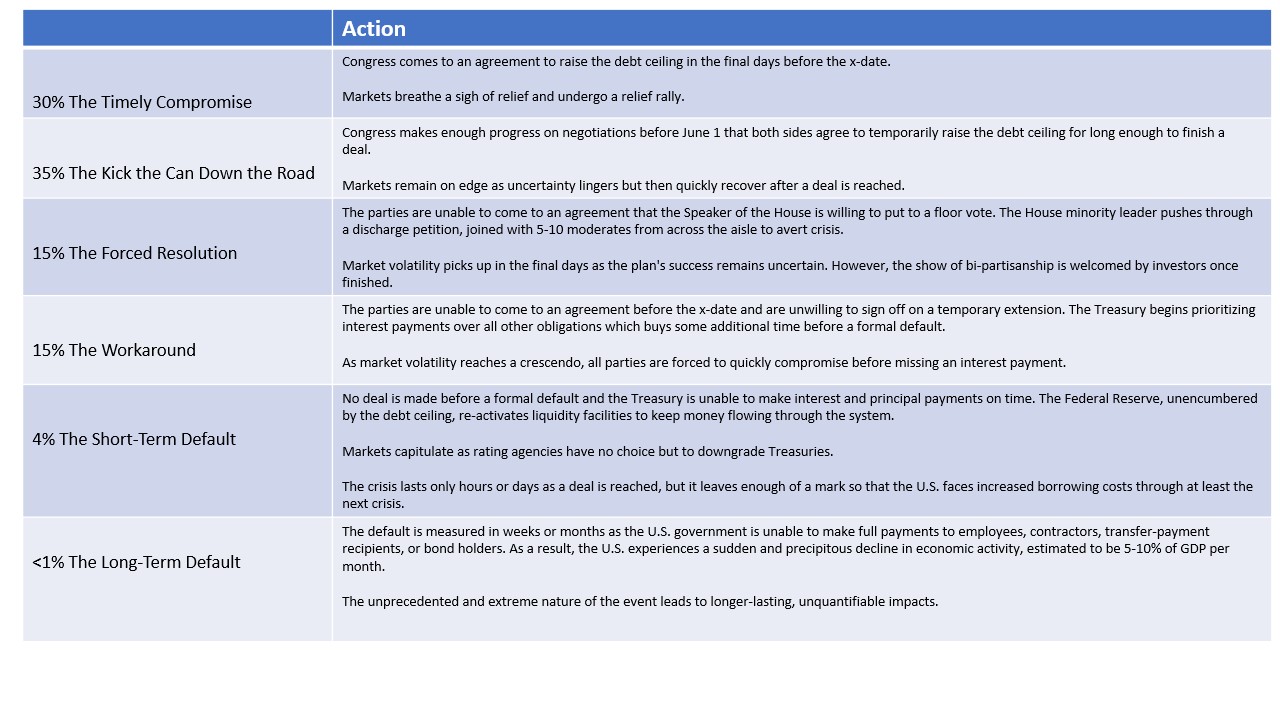

While we are confident that all U.S. obligations will be paid in full, the path to a resolution likely to be messy. With less than a month to the forecasted x-date and little progress towards a compromise, it’s hard to imagine a deal being done in time. We present a few potential scenarios below:

Investor Implications

We have spent a lot of time over the last several months thinking through what’s safe if Treasuries aren’t. There are options that have worked in the past; however, there are no guarantees that they will work in the current environment. This uncertainty leads us back to our old standby of diversification.

- Bonds – While it might seem that the last thing an investor would want to own during a Treasury crisis is U.S. Treasuries, historically, this has been a good place to be invested during crises. During the 2011 debt ceiling debates, for example, investors flocked to Treasury bonds, even after the rating-agency downgrade.

- Non-dollar denominated holdings- While we believe that concerns that the U.S. dollar is on the verge of losing its status as the world’s reserve currency are overblown, they might be directionally appropriate as central banks have been increasingly diversifying their currency reserves away from dollars (a/k/a dedollarization). Holding non-US stocks and bonds could benefit from a continued shift away from the dollar.

- Currency alternatives – Gold assets could benefit from volatility in fiat currencies. Cryptocurrencies, which were originally designed as a substitute for fiat currencies, may also benefit; however, its struggles to define itself as it continues to emerge may reduce its effectiveness as a hedge.

Of course, we would be remiss not to point out that in our table above, 80% of the outcomes are rather benign and 95% do not result in formal default. The potential rally in U.S. stocks on the other side of those outcomes should not be discounted.

At The Colony Group, we design portfolios to have exposure across asset classes to increase our opportunities for gains while attempting to limit severe losses. As the next few weeks unfold, we intend to take the same steady approach that has guided us for the last 36 years: to manage through the volatility and keep our clients on the right financial track. Should our estimation of the probabilities for these scenarios change, we are prepared to re-position portfolios as needed.

Disclosures

The Colony Group, LLC (“Colony”) is an SEC Registered Investment Advisor with offices in Massachusetts, New York, Maryland, Virginia, Florida, Colorado, California, New Hampshire, Connecticut, Washington D.C., and New Jersey. Registration does not imply that the SEC has endorsed or approved the qualifications of Colony or its respective representatives to provide the advisory services described herein. In Florida, Colony is registered to do business as The Colony Group of Florida, LLC. Colony provides individuals and institutions with personalized financial advisory services.

This blog is prepared using third party sources. Colony considers these sources to be reliable; however, it cannot guarantee the accuracy or completeness of the information received.

This blog represents the opinions of Colony, may contain forward-looking statements, and presents information that may change due to market conditions or other factors. Nothing contained in this blog may be relied upon as a guarantee, promise, assurance, or representation as to the future. Information provided herein is general and educational in nature. It is not intended to be, and should not be construed as, investment advice. Market conditions can vary widely over time and can result in a loss of portfolio value.

Colony’s services are provided pursuant to an advisory agreement with the client. Colony’s Form ADV Part 2A, 2B, Form CRS, and Privacy Notice will be provided on request and as required by law. For a description of fees payable for investment advisory services, please see Colony’s Form ADV Part 2A.