Q1 2024 Colony Market Perspectives

Introduction

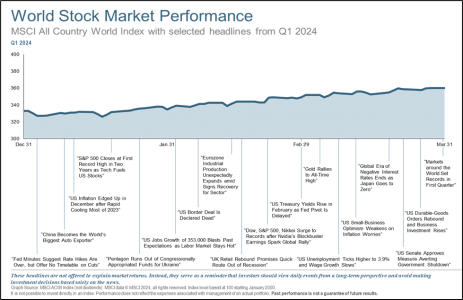

The calendar might have turned the page to a new year, but the market continued to march higher, with the S&P 500 recording its strongest first quarter return (+10.6%) since 2021. Once again it was the Magnificent Seven leading the way, although equity market leadership began to broaden in March.

Despite inflation remaining stubbornly high, all three U.S. major indices – S&P 500, Dow Jones Industrial Average, and NASDAQ Composite – achieved all-time highs during the quarter, returning +10.6%, +6.1%, and +9.3%, respectively. Overall growth ran hotter than expected causing investors to rethink their expectations for the number of Federal Reserve (Fed) rate cuts this year. The market’s resilience in the face of higher-for-longer interest rates is surely reassuring to investors and, perhaps, is indicating that the Fed may orchestrate an elusive soft landing (growth slows but does not contract).

Outside the U.S., equity markets generally posted solid first quarter gains but failed to keep pace with their domestic counterparts. For the quarter, the most glaring underperformance came from Chinese equities. China’s stock market languished in January as investors remained concerned that President Xi Jinping is favoring structural reforms over growth initiatives. Chinese economic activity showed signs of thawing in February and March, however, as the government sought to reassure foreign investors and businesses. This helped Chinese equities rebound during the last two months of the quarter even though they remain significantly below their 2021 highs.

Stronger than expected growth and sticky inflation during the first quarter led investors to downgrade their expectations of the number of Fed interest rate cuts. Investors entered 2024 expecting the Fed to cut six times. Today, the market is suggesting only two or three cuts. As a result, longer-term interest rates drifted higher causing the Bloomberg US Aggregate Bond Index to return -0.8% during the quarter.

Interestingly, Bitcoin and gold both reached all-time highs in early 2024. In January, the courts forced the SEC to relent and approve the first spot-bitcoin (BTC) exchange-traded product; however, the SEC made clear that product approval was not an endorsement. The first few weeks following the approval there was limited price effect on BTC, but a combination of broad optimism stemming from the equity bull market and the upcoming “halving” (when the reward for “mining” a Bitcoin is cut in half to create greater scarcity) has BTC back in the spotlight.

The reason behind gold’s strength is a little less obvious. It is unclear whether gold rose because of still-elevated inflation or flaring geopolitical risks. Maybe, as Louis-Vincent Gave of Gavekal Research suggests, the increase reflects Japanese and Chinese investors reacting to their currencies devaluing. Finally, the price action of both Bitcoin and gold may suggest an incipient loss of confidence in the U.S. dollar over the unsustainability of the government’s fiscal situation.

The first quarter was stained by the loss of a pioneer in the field of economics and investments. Noble-prize winner Daniel Kahneman died at the age of 90. In the first section below, we take a closer look at some of his work and the lessons we learned from them.

We also look at the global transition to renewable, clean energy. Whether or not you agree that the earth’s climate is changing, the world is seemingly moving forward with the transition, creating opportunities for sustainable investments. Those electing to avoid fossil fuels investments altogether may be doing themselves a disservice from an economic perspective. The transition will require striking a balance between traditional and renewable forms of energy as the necessary technology to facilitate electrification progresses. We attempt to lay out a constructive investment case for both traditional and renewable energy below.

Remembering a Legend

Daniel Kahneman, who won the Noble Prize for Economic Sciences in 2002, died this March at the age of 90. Kahneman arguably did more to advance our understanding of behavioral economics than any of his predecessors. His work on human judgment and decision-making is considered groundbreaking. Most notably, Kahneman disproved the notion within economics that humans behave rationally (amazing as it may seem to us that this needed proving) through the identification of behavioral anomalies that often limit us as investors.

Much of Kahneman’s work centered around his so-called “prospect theory,” which demonstrated that the pain people feel from losses is twice the intensity of the joy they receive from gains. Prospect theory essentially launched the field of behavioral economics. Kahneman continued to discover heuristics and biases in peoples’ judgments that are associated with common investment errors. He believed that they occurred because decision-making originates from two modes of thought: System 1 is fast, intuitive, and instinctual, while System 2 is slow, deliberate, and analytical.

Most investors have likely, at some point, fallen victim to one or more of the heuristics identified by Kahneman. For example, anchoring, or the habit of allowing a decision to be affected by a reference point, frequently results in an investor aggravating the magnitude of loss from an investment. The classic example of anchoring is holding on to a falling stock in hopes that it recovers back to the initial purchase price. Many investors reduce their reference point along the way when a stock declines in the hope of recovering some of the loss before selling. Selling winners too soon and hanging on to losers too long is arguably the most common mistake made by investors.

Another example of an irrational mental shortcut identified by Kahneman is referred to as recency bias. Humans frequently place too much weight or importance on recent events. This likely occurs for the simple reason that recent events are easier to recall. Momentum investing is a good example of recency bias. A rising stock attracts the attention of an increasing number of investors pushing the stock price even higher. In many of these cases, the company’s fundamentals eventually fail to support the stock’s valuation or keep up with investors’ expectations, causing the stock to ultimately crash as investors flee, turning a virtuous cycle into a vicious one.

What this means?

There are so many lessons to be learned from Kahneman’s work. Most notably, we must be careful not to always trust our instincts because System 1 judgments are more prone to errors.

This argues for careful and considered decision-making. Drawing conclusions from a well-constructed analytical framework helps to ensure that our decision-making is consistent, and we believe that gives us a competitive edge over our peers.

We believe our studies of Kahneman’s work help us both avoid pitfalls and exploit opportunities. By watching out for recency bias, we can avoid securities that may become overbought due to popularity rather than fundamentals. Moreover, we remain alert to not anchor around a reference point, allowing us to retain winners and sell quickly when the facts that underwrote a decision change. By recognizing these patterns as they are occurring, we can take advantage of flaws in other market participants who are less aware that humans are naturally poor investors.

One of The Colony Group’s core values is lifelong learning. Daniel Kahneman epitomized this, publishing his last book at the age of 87. We trust that others will carry on his work in analyzing how the psychology of individuals impacts investment markets.

Fossil Fuels vs Renewable Energy – Both Could Win

World leaders generally agree with the theory of climate change and are promoting policies to address it. In 2015, 196 countries assembled in Paris to negotiate an agreement to substantially reduce the impact of climate change. 195 countries signed an agreement; Iran was the only major emitter of CO2 not to ratify it. The so-called Paris Agreement sets long-term goals that call for nations to reduce global greenhouse gas emissions to hold global temperature increases to “well below 2°C” above pre-industrial levels and to provide financing to developing countries to make progress towards this goal.

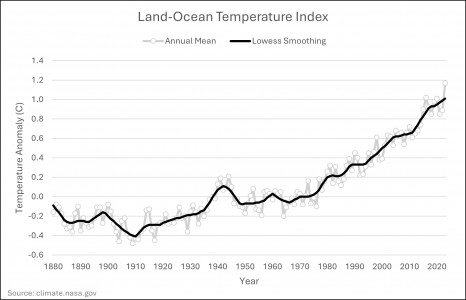

To be clear, we do not intend to wade out into the debate around what is causing the climate to change or if and how the world should respond. As investors, we feel duty-bound to consider the impact of any policy responses to our portfolios. Assuming the trend of rising water temperatures continues (see chart below), global policymakers are likely to continue to seek ways to combat the rise and mitigate its impacts.

The Paris Agreement should catalyze spending on renewable energy over the coming decades. Indeed, according to Michael Cembalest of JP Morgan Asset Management, fossil fuel’s share of global energy use is falling 0.4% per year. Arguably, the most progress has been made in transitioning the fuel used to power the electric grid. Countries are shifting away from coal, oil, and (relatively clean) natural gas, towards wind and solar. One issue that is slowing down progress is that wind and solar are intermittent forms of energy requiring redundancies and/or the ability to store it. Nuclear energy, once a popular alternative, took a hit following some catastrophic accidents but is beginning to be reconsidered.

Nevertheless, fossil fuel use continues to grow as the supply of clean energy cannot keep up with overall energy demand. In fact, based on our current technologies, it is unlikely we can reach the milestones for renewables called for in the Paris Agreement in the agreed upon timeline. Our understanding of chemistry and physics is perhaps the most noteworthy limitation; however, cost, politics, and human behavior are also conspiring against a quicker energy transition.

Certainly, the costs of transitioning could be a significant headwind. While the marginal costs of renewable energy sources are falling, the capital outlays to replace existing infrastructure are significant, especially considering today’s higher cost of financing. When you consider that four of the five most populous countries in the world are developing markets (a/k/a, emerging markets), it underscores the challenge of transitioning the world to clean energy. Emerging markets are less motivated to transition as their economies are more energy intensive and many of them do not have the financial wherewithal to make the needed capital investments.

Several years ago, traditional energy companies shifted their strategic priorities. In addition to making their own investments in clean energy, they began to emphasize the return of cash to shareholders over capital investment in exploration and production. A reduction in investment in developing new wells coupled with OPEC+’s reduction in production quotas has caused the traditional energy markets to be undersupplied.

What this means?

We believe the next few decades will offer attractive investment opportunities in both renewable energy and fossil fuels. The Paris Agreement will likely accelerate spending and capital investment targeting clean energy. This should allow clean energy to continue to take market share from traditional energy.

It would be difficult for any one country to manage such a transition within its own borders. It may be near impossible to manage such profound secular changes globally. For example, the amount of time between when an energy company makes an investment in a well to when that well actually produces oil is far too long to allow the industry to respond promptly to supply and demand imbalances. This helps explain why we believe the transition will be volatile, marked by periods of over and under supply. Patient and disciplined investors are often able to exploit this sort of volatility by turning it into opportunity.

Conclusion

Investment markets are enjoying a relatively benign macro environment. Global inflation continues to decelerate, albeit not as fast as some had hoped, and growth is relatively robust. The strong equity market returns over the past 18 months reflect this.

The rising tide has not lifted all boats equally, however. While stocks in the technology and communication sectors have thrived during the past year and a half, energy and utility companies have lagged relative to the broader index. As countries ramp up spending to facilitate the energy transition, we expect opportunities to emerge from both sectors.

The world is complex, and investors must have some familiarity with a range of disciplines to be successful: geopolitics, economics, finance, meteorology, technology and science, etc… Kahneman proved that psychology should also be considered when trying to come to a decision. His teachings seem more relevant today than when he started his work with his collaborator, Amos Tversky, back in 1969.

Sources: Financial Times, Wall Street Journal, NASA, JP Morgan Asset Management, and Gavekal Research