Pessimism Sells, but Optimism Pays

A 2019 study by the National Academy of Sciences confirms the widely held belief that humans are drawn to negative news. Results from a 17-country, 6-continent study showed that modulating the tone of a video to be more negative increased attentiveness and arousal. The lesson here is clear, if you are seeking attention: go negative.

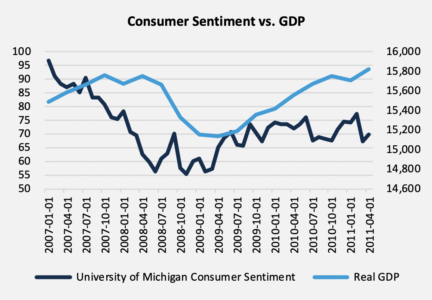

Pessimism is also more enduring. For example, consumer sentiment followed economic growth downward during the Great Recession (2007-2009); however, confidence failed to keep up with the economy as it improved. Indeed, the economy fully recovered to pre-recession levels by the end of 2011, however, consumer confidence recaptured only half its decline. It took until 2014 for consumers to feel confident again.

Source: University of Michigan, Bureau of Economic Analysis

One of our colleagues and portfolio manager, John Schott, M.D., provides insights as to why this happens. John is a retired psychiatrist and expert in behavioral finance. In his book Mind Over Money, he explains his concept “Bear Market Depressive Syndrome (BMDS).” He finds that many investors become gripped by feelings of guilt and shame over losing money. The experiences of BMDS parallel the clinical symptoms of depression, including, among others, an increased likelihood of pessimistic thoughts.

In investing, however, it rarely pays to be overly dour. Markets have generally risen more than they have fallen. Since 1928, the S&P 500 has increased in value 53% of the time on a daily basis, 59% on a monthly basis, 63% on a quarterly basis, and 66% on an annual basis. Over longer holding periods, the numbers become even more impelling, with 79% of all monthly rolling 5-year periods and 88% of all monthly rolling 10-year periods posting positive returns.

Source: Morningstar, S&P

Periods of uncertainty and consternation are generally good times to invest. The S&P 500 has, on average, returned 11.4% in the 12-months following a consumer sentiment reading below 75. Periods of greater confidence (a reading above 100) have, on average, returned a lower 8.0%. This bodes well for future returns, in our opinion, considering that the August reading of consumer sentiment was 72.8. [1].

Today’s low readings likely reflect a variety of concerns weighing on investors, including the U.S. elections in November, the global pandemic, and a stock market that has risen more rapidly than what the economic data might suggest.

To help investors assess these concerns, we developed a simple, three-question evaluation:

- What is the likelihood of the event?

- How impactful might the event be?

- Are there other dynamics that might mitigate the event?

While we intend to cover potential election outcomes more broadly in our quarterly Market Perspectives in October, we thought it would be useful to use fears involving higher taxes and the election as a case study in how we evaluate concerns. You may not be surprised to learn that we have a more moderate view of election risk versus what you hear on TV or read in print.

LIKELIHOOD

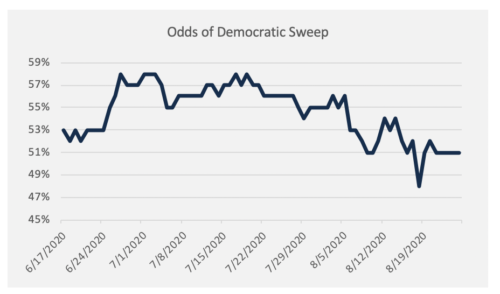

As of this writing, the probabilities slightly favor a Democratic sweep of the White House, Senate, and House of Representatives at approximately 51% according to PredictIt.org. This is important because Biden is unlikely to pass tax reform unless his party controls both the House and Senate. Tax policy may be a campaign priority for Vice President Biden but seems less likely to be an immediate policy initiative given that the economy will probably still be recovering at the outset of his first term. Even if odds makers suggest a slight edge toward the Democrats winning broadly in November, there is a smaller chance that they are able to implement broad tax increases in their first year.

Source: PredictIt.org

IMPACT

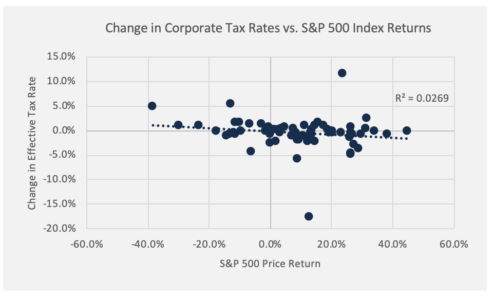

While an increase in corporate tax rates could lead to volatility as investors recalibrate earnings expectations, the relationship between taxes and stock prices is weak. Investors tend to quickly factor in the tax change and move on to estimates of growth from the new base level rather than focus on the change. Increases in effective tax rates deliver, on average, lower but not necessarily negative returns for the S&P 500. The chart below shows low correlation between changes in tax rates and the subsequent 12-month change in the S&P 500.

Source: Empirical Research Partners, S&P, The Colony Group

OTHER DYNAMICS

Assuming that Biden will not raise taxes while the economy is below pre-COVID levels, we can expect that the passage of a tax reform bill is likely concurrent with higher than expected economic growth. In this case, Biden’s tax plan might still slow the economy (and/or the stock market) but from growth rates higher than currently expected.

Biden proponents might argue that other elements of his platform may offset tax increases. Proposals such as a more diplomatic approach to trade, incentives to buy domestically produced goods, higher research and development credits, and investments in clean energy could stimulate the economy.

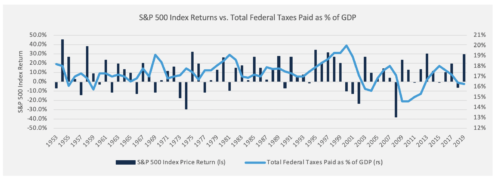

When looking at past changes to corporate and individual taxes as percentage of GDP, there are several instances where stocks rose despite increasing taxes; other dynamics were in play that overcame the impact of the tax change. In the mid-to-late 1990s, for example, stocks rose sharply on the back of a roaring economy and burgeoning technology sector.

Source: S&P, Morningstar, Office of Management and Budget

POSITIONING FOR UNCERTAINTY

While prudence is warranted in times of heightened uncertainty, we also believe that portfolio decisions should reflect a perceived risk’s likelihood, potential impact, and the other dynamics in the markets. In most cases, we believe that moves should be moderate. In our opinion, the likelihood of a significant tax overhaul in 2021 is relatively low. Even if we are wrong, we expect that, while it may spark a reaction over the short run, its impact should be tempered over the longer term. Other dynamics, as outlined above, may mitigate the headwinds from higher taxes on the market. For many client portfolios, we have increased our allocations to more defensive equity positions and allocated to diversifying assets that are less correlated to the equity markets. We believe these actions reflect the risk in the markets but, as always, we remain nimble should the facts change.

[1] Surveys of Consumers, University of Michigan