Let the Games Begin

Campaigning for the general election has unofficially begun and so has the quadrennial discussion over whether investors should care. Generally, we believe the answer is no. The US economy’s and stock market’s track record of persevering through various political regimes and government dysfunction is well established. This month, we discuss three common myths regarding politics and investing.

But first, a caveat. Any analysis of election or partisan control dynamics suffers from a significant flaw: a small sample size. With the presidential election occurring only once every four years, an analysis of modern markets (i.e., post-World War II) has just 19 data points. Thus, exogenous events such as COVID-19 in 2020, the Global Financial Crisis in 2008, and the dot.com bubble of 2000 can overly influence the results. Some may argue that government policy was responsible for many of these events; however, the engendering policies and their consequences were likely years in the making. It is probably inappropriate to assign blame or praise only to those who happened to be at the helm when the reckoning came.

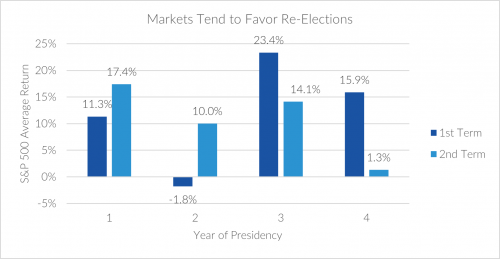

Myth: Election Years Are Tough For Investors

Why It Rings True: Investors typically hate uncertainty, and few things feel more uncertain than a year when both the executive and legislative branches of the Federal Government are up for grabs.

The reality is more nuanced. In our analysis, markets perform much better when one candidate is up for re-election rather than two first-time candidates. Indeed, in years that an incumbent president is running for re-election, markets have historically experienced strong returns. We believe this phenomenon manifests for two reasons: 1) at least one of the candidates has a policy track record (reducing the unknown) and/or 2) the candidate pushes through pro-growth policies in support of their re-election campaign. Notably, these may also explain why the 3rd year of a first-term President tends to offer the strongest returns as the candidate puts policies in place to aid their campaign.

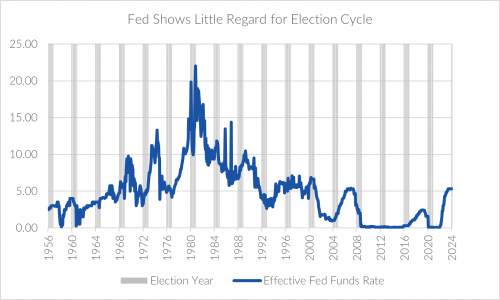

Myth: The Fed Won’t Move During An Election Year

Why It Rings True: With the most pressing election issue being the economy, the Fed’s actions can significantly impact voter sentiment. The Fed values its independence and recognizes the importance of its credibility as the nation’s central bank.

While many believe that the Fed will go out of its way to avoid the appearance of interfering with the election, we feel the same goal keeps them on their path. Monetary policy inaction may be just as impactful to the central bank’s credibility as action. Indeed, since 1956, the Fed has shown little regard for elections when deciding on its strategy. In recent history, over the past 11 election cycles, the Fed has hiked five times, cut rates five times, and held steady just once.

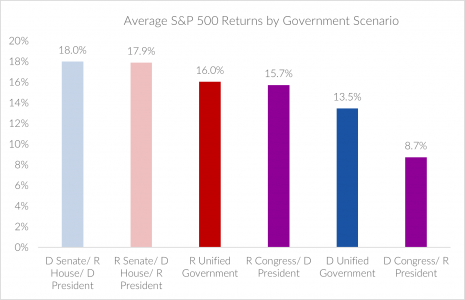

Myth: Any Specific Election Result Spells Doom or Success For Investors

Why It Rings True: The President sets the agenda for fiscal policy, so assuming that the election will have significant consequences for company earnings is natural.

Without commenting on social policies that can dramatically impact the day-to-day lives of many Americans, most economic policies tend to be more at the margins. Indeed, most professional investors tend to look through things like tax changes and one-time bumps in earnings and focus on longer-term business dynamics. Thus, markets tend to find their own way no matter the political cycle. Nevertheless, the best returns tend to come in environments where compromise is both required and there’s a path for it. When the same party controls the White House and the Senate but not the House, economic policy tends to be more moderate and returns higher. We note, however, that the worst outcome in our chart below is still an average 8.7% return for the S&P 500.

What’s Different This Time?

There is no shortage of reasons to believe this election differs from recent experiences. Most notably, a former president has not run for re-election since Herbert Hoover in 1940, and whichever candidate wins, they will be the oldest person ever re-elected to the White House. Arguably, the fact that both candidates have track records of policy priorities and legislative effectiveness should ease investor consternation in forecasting the likely direction of policy.

As citizens, we encourage everyone to get out and make their voices heard during this important election season. However, we believe investors are better served by leaving the politics out of their investment decision making and focus on the long-term drivers of corporate earnings and shareholder returns, which have successfully navigated political headwinds for decades.