Investment Soup: A Recipe for Financial Success

While you may never have considered it before, whipping up a sumptuous recipe in the kitchen has a lot in common with building a savvy financial portfolio. The skills and approach you would use to cook up, say, a delicious and nourishing soup, are very similar to the way you should be establishing the foundation for your long-term financial future. Please join me in my “kitchen” to find out more about how preparing something as simple as soup can teach you plenty about how you can cook up your future financial success.

Step 1: Decide What You Want To Make

Before you even begin cooking, you need to first answer a few questions, like: Do you have a good recipe you want to follow? Will your soup be the start of a special meal – or a hearty meal all by itself? How long will it take to prepare? Do you or your loved ones have any dietary restrictions? By answering questions like these, you’re more able to identify the kinds of ingredients you’ll build your meal around.

It turns out that you can use very similar pre-planning questions when starting to map out your investment plan:

- What are your investment goals?

- What is your time horizon?

- What is your risk tolerance?

- How much money will you start with?

- Will you continue to add money on a regular basis and will you need to take any withdrawals from your portfolio?

- Are you committed to maximizing your investment plan through all market cycles?

Your answers to questions like these will go a long way in helping to shape the recipe for the financial plan that will work best for you.

Step 2: Follow Your Recipe

Once you know what ingredients you’ll need for your meal, it’s time to consult the recipe to determine how much of each you’ll need to use. A good chef carefully measures and mixes all the ingredients together to create a flavorful soup so that no single ingredient will overpower the taste. The best flavors come from balancing and blending!

A good investor also carefully combines multiple asset classes to create a well-diversified portfolio that generates consistent long-term returns along with reduced risk. Each asset class has its own risk/return profile and behaves differently over time based on a series of variables such as the economy, interest rates, inflation, specific industries, and the markets. When you find the right balance of assets, the end result can be a more consistent return with fewer bumps and volatility.

If we were to think about our financial plan as a soup recipe– let’s say we want to make a Roasted Carrot Ginger Soup – our list of ingredients might look like the following:

Your stocks (your vegetables) form the core of your long-term growth assets, which is why they represent 60% of your recipe. Just like you need to pick fresh vegetables for your soup, you need to have a solid collection of stocks or stock funds in your portfolio.

Investing in stocks is essentially buying ownership in a company. Some companies pay regular dividends from earnings (which is characteristic of a “value” stock) while others reinvest their profits and pay no dividends (which we typically call “growth” stocks). Your goal should be to have a mix of both, as well as businesses that are based around the world and that invest in multiple industries. A well-diversified stock portfolio also consists of different-sized companies including a range of large, mid, and small capitalization.

In terms of the stocks, or vegetables, in our recipe, we might have a shopping list that looks something like:

But to make a delicious soup – and a diversified portfolio – we need more than just vegetables.

Next, we need to add some broth – or bonds – to our pot. Bonds are steadier and less risky than stocks, which brings that smooth consistency we look for in both a soup and a portfolio.

But we also don’t want things to be too bland, so our recipe calls for a dose of ginger – or a “multi-strategy” asset class, which invests in various strategies that have a lower correlation to both stocks and bonds. The goal with these assets is to achieve annualized returns of approximately 5% to 8% with a bit higher risk than bonds.

Our recipe also calls for some brown sugar, which we call “Real Assets,” and are investments in real estate, commodities, master limited partnerships, and other assets that tend to share characteristics of both stocks (earnings growth) and bonds (yield).

As a final touch to our soup, adding a little butter, or cash, allows you to take advantage of unique opportunities.

Now, grab a glass of wine…

Let’s pause for a moment to talk about the value of diversification when it comes to selecting the ingredients in our recipe. It might be tempting to load up on U.S. stocks, for example, since they have outperformed foreign stocks on an annual basis since 2010. But it’s critical to note that all asset classes have cycles. The U.S. does not have a monopoly on stock market returns, profit growth, dividend payments, innovation, or good ideas.

At some point, cycles turn and under-performing assets suddenly begin to outperform last year’s stars. No one can predict when cycles change.

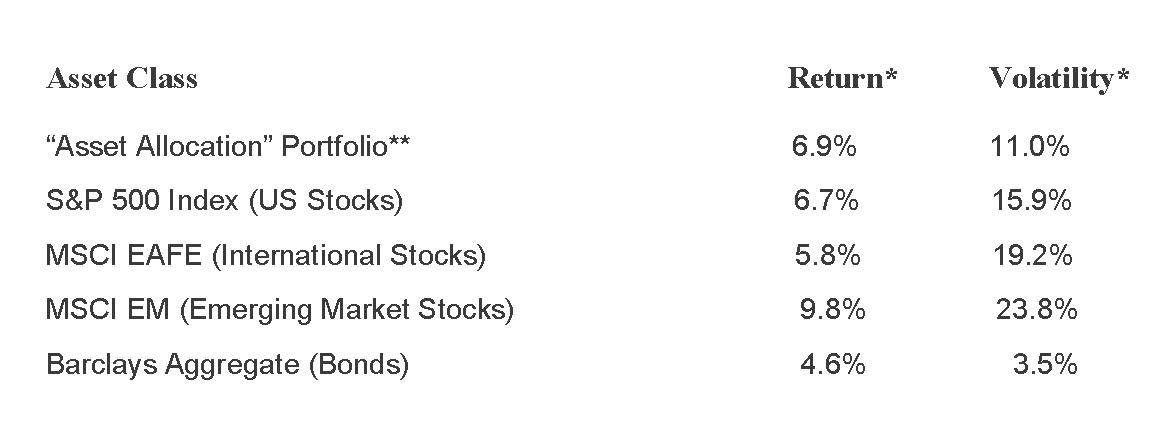

Consider the following chart, which shows annualized performance and volatility over the past 15 years – from 12/31/01 to 12/31/16 – as reported in JP Morgan’s Guide to Markets published as of 12-31-16:

Two major market downturns, multiple natural disasters, and numerous geopolitical conflicts have given investors a volatile ride in recent years. But those who had built diversified portfolios were better able to buffer those market downturns while still reaping attractive returns.

Step 3: Use Different Cooking Techniques

Not only can a diversified mix of ingredients make a better recipe, a good cook can also use a variety of techniques like roasting, blending and boiling to develop layers of flavors. Similarly, your investment portfolio can use different investment vehicles such as individual securities, mutual funds and exchange-traded funds (or ETF’s), to generate desired returns. There are many good mutual funds and ETF options, for example, that are passively managed to mirror specific benchmarks like a market index. There are also actively-managed funds and ETFs that are designed around specific investment objectives. Both vehicles can enhance your financial recipe as they offer professional management, diversification, liquidity, and low transaction costs.

Here are a few resources to help you become more familiar with these investing options:

Investopedia Mutual Funds Basics Tutorial

Investopedia Exchange Traded Funds

Step 4: Add Spices – But Use Them Judiciously

How much to spice-up your recipe is a personal preference – but don’t let your emotions get the best of you. Think of “over-spicing” as greed and “under-spicing” as fear.

Some investors think they can outsmart the market by timing their investments. But investing too heavily in one stock or sector can add a lot more risk than you intended, which is why it’s critical to be mindful of over-concentrating your portfolio in risky assets.

Fearing every market downturn, on the other hand, is not only emotionally draining, it could result in missing the best days of the market and deter you from reaching your long-term investment goals.

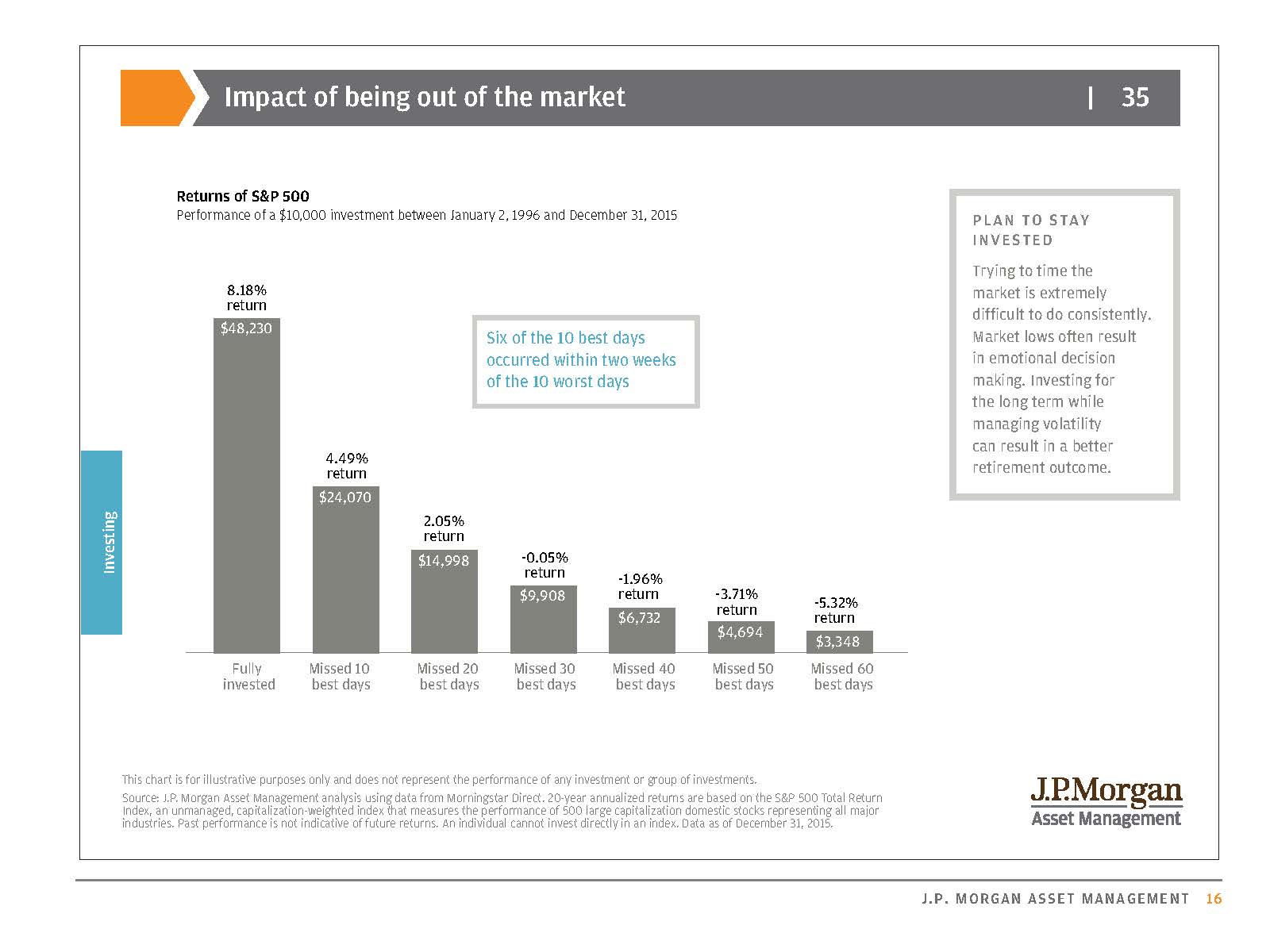

These two charts illustrate why it’s smart to remain invested for the long-term at all times and accept volatility as a normal part of investing.

The first chart shows what happens if you try to market time and miss the best days of the market. Simply put, an investor who stayed fully invested in the S&P 500 from 1996 through 2015 had an average return of 8.2%. Had you tried to time the market and missed the 10 best days in the market, your average annualized return for the same 20 years would have been 4.5%. Worse, if you missed the 20 best days, your return would have been just 2%.

The next chart shows that during the 37-year period from 1980 thru 2016, the S&P 500 had positive annual returns in 28 of those 37 years ( ~ 75%) and 9 years of negative or zero returns ( ~25%).

However, and this is important, the average of all intra-year drops from top to bottom during each of these 37 years was 14.2%. In other words, volatility is a normal part of investing, so don’t let it derail you. Investors need to stay invested and not over-react, so spice carefully!

Step 5: Skim Off The Fat

Everyone tries to eat healthier these days, and sometimes that means ladling off any fat that bubbles to the top of your soup.

In the investment world, “skimming off the fat” means being mindful of lower fees and tax-efficiency. Simply put, you should invest in funds that have no upfront commissions or loads. You should also look at your fund’s expense ratio relative to its peers for the lowest expenses. A passively-managed-index fund or ETF will charge a lower fee than an actively-managed fund. Compare net-after-fee returns between different funds to justify paying higher fees.

Investors and market timers who trade often generally experience higher transaction costs compared to a buy-and-hold strategy.

In terms of tax-efficiency, capital gains realized from investments held for longer than 12 months will be taxed at the more favorable long-term capital gains rate than if held for under 12 months. It pays to be mindful of short-term vs. long- term timelines.

Step 6: Taste Your Soup Often

Just like a soup needs to be stirred occasionally and tasted for flavor, your investment portfolio needs to be checked and rebalanced regularly. Do not leave your portfolio on “auto-pilot.” Make a point of reviewing your quarterly performance reports and rebalance your portfolio when the asset classes in your recipe start getting out of alignment by more than 10% from your intended weightings.

Step 7: Simmer For Best Results

The final ingredient to a tasty soup is patience; the longer you let it cook, the tastier it becomes as the flavors continue to develop.

Investing also takes patience. Money grows on money by compounding each year! If you invest $1,000/month for the next 40 years (a total of $480,000), your portfolio’s future value would look like this:

The point is that investors, like chefs, should start with a great recipe, solid technique and let the flavors develop to their full potential over time.,

Oh, and try my favorite recipe for Roasted Carrot Ginger Soup. It really is delicious!