Investing with Values – Q3 2020

Over the last several months, the issues of racial inequality and social and economic injustice have risen to the forefront. While these issues have persisted for years, the collective response is different this time. Not only have we witnessed a broader coalition of people protesting injustice in the streets, we have also seen public corporations join the fight. In this issue, we highlight the ways investors can participate, too.

“In constructing portfolios, we must redouble our efforts to understand how the companies in our portfolios are behaving with respect to diversity, inclusion and equality — avoiding companies that countenance discrimination in any form and investing in companies that genuinely embrace diversity, equality, and our common future.” Joe Keefe, President and CEO of Pax

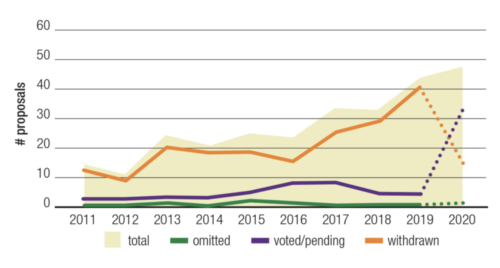

First, investors can align their portfolios with fund managers who have consistently valued the economic and social benefits of diversity, equity, and inclusion. Sustainable fund managers consider a company’s practices towards equality, diversity, and human rights as material; these factors affect which companies they invest in and which companies they engage with to improve outcomes. In 2019, there were 44 shareholder-led proposals to change board nominee requirements to include diversity criteria. Companies took notice and were generally receptive – all but four of the proposals were withdrawn after the company took meaningful steps toward inclusion. Our clients’ investment with Boston Trust Walden, for example, helped to secure commitments from three companies-Choice Hotels, Hyatt Hotels, and Williams-Sonoma-to provide annual disclosure of diversity, equity, and inclusion metrics and initiatives.

Secondly, an even more targeted approach is through impact investing. Investors can direct capital to strategies that seek specific and measurable social or environmental outcomes as well as financial returns. Impact bonds, found within certain sustainable fixed-income funds, are a perfect example. The CRA Qualified Investment Fund currently allocates 37% of its portfolio to support affordable housing and 14% percent to benefit minority advancement. One investment involved the revitalization of a low-income, majority-minority, affordable rental property located in a high-poverty census tract in Minneapolis. A primary objective of that bond issue is to provide a durable, healthy, and stable living community. Since its inception in 1999, Community Capital Management has invested $3 billion in the impact theme of minority advancement across 48 states. The TIAA-CREF Core Impact Bond Fund dedicates 40% of its portfolio to impact bonds in four key areas. Recently, the fund invested in a vehicle that aims to reduce homelessness and prison recidivism rates.

Board Diversity Outcomes

Source: https://www.proxypreview.org/2020/report 1

Thematic Spotlight: Women’s Leadership

While progress has been made in a number of critical areas related to the equitable treatment of women, there is still plenty of work to be done. According to the World Economic Forum, it will take 99.5 years to achieve global gender equality. In addition, women comprise just over 20% of board seats in the US. Yet several studies have shown that companies with more women in leadership positions are more profitable, innovative, productive, and maintain higher levels of employee satisfaction and retention. Thus, investing in a women’s leadership theme may help clients realize both societal and financial objectives.

The Pax Ellevate Global Women’s Leadership fund is a diversified, global equity fund that invests in companies that rank highly for advancing women through gender pay equity, gender-diverse boards, senior leadership representation, and other practices such as benefits and talent pipeline management. The fund also frequently engages directly with companies to advance gender equality issues, increase disclosure, and effect positive change. This has led to a number of successful outcomes over the years, an ideal way to impact an issue many clients feel strongly about.

Sustainable Investing in Action

Colony Investing Solutions

Some statistics of interest from The Colony Group’s Sustainable Investing Solutions equity portfolio:

Sources:

[1]Relative to MSCI All Country World Index

[*] Scope 1 Global Emissions are direct emissions from sources that are owned or controlled by a corporation

For more information about Colony’s Sustainable Investing Solutions, please reach out to your wealth advisor or contact us at info@thecolonygroup.com.