Investing with Values – October 2020

October Observations

We are simultaneously facing three fundamental crises: the Covid-19 pandemic, racial inequality and social injustice, and climate change. Undoubtedly, albeit to varying degrees, these challenges have impacted our lives or communities. In the previous two issues of Investing with Values, we focused on the first two challenges. In this issue, we address the third. Importantly, we discuss how investing through an environmental lens can enable investors to achieve positive impact while striving to capture attractive, long-term financial opportunities.

Climate change statistics are alarming, to say the least. The planet’s average surface temperature has increased 1.62 degrees Fahrenheit since the late 19th century, with most of the warming occurring in the last 35 years (climate.nasa.gov). Six of the warmest years on record have occurred since 2014 (climate.nasa.gov). Five of the six largest wildfires in California history are burning simultaneously as we write this. Last year, the Greenland ice sheet had its worst year on record, shrinking by some six hundred billion tons (Columbia Magazine, Fall 2020). We believe investors can be part of the solution to these challenges by investing in companies with a low-carbon footprint and in those contributing to and benefitting from a secular energy transition away from fossil fuels.

Many studies have demonstrated a positive correlation between greenhouse gas (GHG) and CO2 emissions and surface temperatures. About half of the CO2 emitted since 1850 remains in the atmosphere (climate.gov), and may take centuries to dissipate, even if carbon-based fuels are gradually phased out. Investing in a portfolio with a low-carbon footprint is one way an investor can positively contribute to carbon neutrality and limit further global warming by the end of this century. Many sustainable funds either completely avoid or have limited fossil fuel exposure. The objectives of this avoidance are twofold-environmental impact and risk mitigation. Fossil fuel companies may continue to be exposed to persistent financial headwinds, political risks, and technological obsolescence. Moreover, certain sustainable funds will actively engage with companies on issues related to pollution, waste management, and energy efficiency to improve their environmental policies or increase climate-related disclosures. As illustrated below, a representative Colony sustainable global equity portfolio has significantly less Direct CO2 and GHG Global emissions than a comparable benchmark.

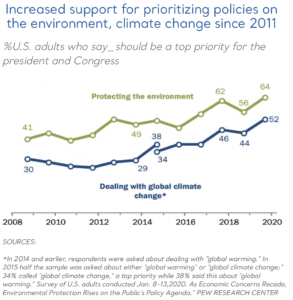

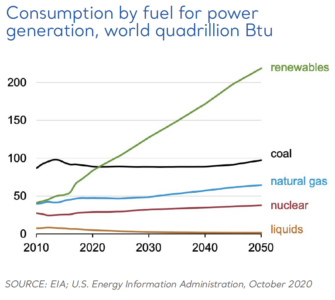

There has been a discernable global, secular shift away from fossil-based systems of energy production and consumption and towards renewable sources of energy. An environmentally conscious investor may wish to tilt her portfolio towards companies participating in this so-called energy transition, thereby realizing the dual objective of positive environmental impact and, potentially, enhanced long-term returns. The Pax Global Environmental Markets Fund is a thematic fund that invests in leading companies developing innovative solutions to resource challenges in the areas of energy efficiency, waste and resource recovery, sustainable food and agriculture, and water. The fund has a net positive CO2 impact.

THEMATIC SPOTLIGHT: WATER

Water access and quality, especially in the developing world, is another formidable environmental challenge, whether resulting from water pollution caused by contaminants from industrial activity and urbanization, shortages caused by overuse and groundwater depletion, or ailing water infrastructure. There is also a prominent link between water and human health. The World Health Organization estimates 2.2 billion people still have no access to water and 4.2 billion have no access to sanitation services. The World Economic Forum has listed water crises among the top-five risks in terms of global impact for eight consecutive years.

The Allianz GI Water Fund is a thematic fund that invests in companies providing unique solutions to global water challenges, specifically focusing on the areas of quality, supply, and efficiency. Each of the fund’s investments aligns with a specific United Nations Sustainable Development Goal and undergoes a thorough ESG analysis. Allianz also engages with portfolio companies and participates in various public policy initiatives aimed at raising awareness of global water challenges. The fund allows investors to have targeted impact on a pressing environmental issue as well as the potential to participate in the long-term, financial tailwinds present in the water sector.

COLONY INVESTING SOLUTIONS

Some statistics of interest from The Colony Group’s Sustainable Investing Solutions equity portfolio:

Sources:

[1]Relative to MSCI All Country World Index

Bloomberg

**GHG Scope 1 Global Emissions are direct emissions from sources that are owned or controlled by a corporation