Investing with Values – Q2 2020

Sustainable strategies had perhaps their first, real litmus test regarding how environmental, social and governance (ESG) factors would hold up as a risk management strategy during the first quarter selloff. The industry generally delivered. Indeed, we believe that corporate responsibility – specifically, those companies that took care of their customers, vendors, and employees – will prove to be winners coming out of the crisis.

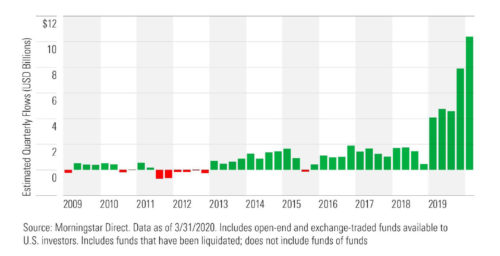

Investors seem to agree. While most equity strategies experienced outflows during the first quarter of 2020, sustainable strategies were a notable exception. U.S. open-end and exchange-traded sustainable funds saw inflows of $10.5 billion during the first quarter, a new record according to Morningstar1.

We believe that corporate responsibility – specifically, those companies that took care of their customers, vendors, and employees – will prove to be winners coming out of the crisis.

The Covid-19 pandemic has provided another unique opportunity to assess the performance of sustainable companies with positive ESG practices. The crisis has offered a real-time test of how material “S” factors (employee safety, community relations, and human capital and supply chain management) as well as “G” factors (management team preparedness, adaptability, and resiliency) have helped or hindered companies’ responses and behavior during the crisis. Positive ESG practices have helped companies to manage risks and should allow them to capture opportunities presented by the Covid-19 crisis. For example, this is an ideal time for companies to strengthen their relationships with employees, their communities, and their supply chains. We believe this will embellish their brands and boost their standing in their communities. Preparedness, positive workplace and supply chain policies, and managerial adaptability are already in sustainable companies’ DNA, and it is not surprising to see their leadership on display.

THEMATIC SPOTLIGHT: POSITIVE WORKPLACE

Allocating capital to companies who have shown a history of creating highly diverse, innovative, safe, and productive work environments can be good for investors and society. These firms often provide fair and equitable pay and benefits and are led by management teams who value inclusion and shy away from groupthink. Businesses with these attributes have enjoyed higher levels of employee loyalty and engagement and thus greater productivity and profitability.

This is more important than ever as organizations need to overcome physical distancing while maintaining a strong corporate culture. A company’s flexibility towards its paid leave and benefits policies and the extent to which it prioritizes employee health and safety during the Covid-19 crisis will go long a way toward ensuring the long-term sustainability of the company. Management resiliency and adaptability will also be tested. Investors will be paying attention.

Sustainable Funds U.S. Quarterly Flows

Sustainable Investing in Action

Financial

- 70% of sustainable equity funds ranked in the top halves of their categories

- 24 of 26 sustainable index funds outperformed the comparable conventional index fund

Engagement

- Following an engagement effort by Calvert, Walmart announced it would stop selling ammunition.

- Pax World Funds engaged with US Foods and Beacon Roofing supply to increase diversity on their boards.

- Parnassus pressured Mondelez to commit to sustainably source its packaging and commit to 100% recyclable packaging by 2025

- Pax World Funds, Community Capital Management, and Parnassus Investments signed on in support of an investor statement on Covid-19 responses. The statement, signed by 195 investors and organizations representing $4.7 trillion in assets, urged business and companies to prioritize employees and stakeholders as they evaluate their responses to Covid-19. The statement emphasized the need for paid leave, employee health and safety, and worker retention.

Corporate Responsibility

- LVMH, the world’s largest luxury goods group, ordered 40 million masks from a Chinese supplier to help with the coronavirus outbreak in France. The company is also producing and delivering free-of-charge hand sanitizers to French hospitals.

- Procter & Gamble has donated millions of their personal health and hygiene products to more than 20 countries and installed new lines at several facilities to produce hand sanitizer for distribution to hospitals and relief organizations.

- Microsoft granted up to three months of flexible paid parental leave for employees affected by extended school closures.

COLONY INVESTING SOLUTIONS

Some statistics of interest from The Colony Group’s Sustainable Investing Solutions equity portfolio:

| 0%

Tobacco Exposure |

<0.5%

Fossil Fuel Exposure |

70% Less1

C02 Emissions |

65% Less1

Greenhouse Gas Emissions |

65% More1

% of Minorities in the Workforce |

For more on Sustainable Investing Solutions, read our Sustainable Investing Primer or our recent article in Worth magazine on thematic investing.

Sources:

[1] https://www.morningstar.com/articles/977328/despite-the-downturn-us-sustainable-funds-notch-a-record-quarter-for-flows

[2] Relative to MSCI All Country World Index