How to Maximize 529 Plans to Pay for Education Expenses (or not)- Part II

529 plans are a tax-advantaged way to save for college expenses because they allow tax-free earnings growth and tax-free withdrawals when funds are used specifically for qualified higher education expenses (QHEE) for full-time or minimum part-time students attending eligible U.S. or international institutions, including two- and-four-year colleges, vocational, and graduate school programs. In addition, 34 states offer a tax credit or deduction for contributions made to their state’s 529 plans. See the list of the deductions by state here.

Establishing & Funding 529 Plans:

When considering a 529 plan for a child in your life, whether parent, grandparent, or otherwise, you might wonder when you should start. The growth on the after-tax money contributed to 529 plans is distributed tax free if the funds are used for a reason deemed appropriate by the IRS (see previous article for how funds from a 529 can be used). With the power of compounding, the earlier you establish and fund a 529 plan, the longer the funds can grow tax free.

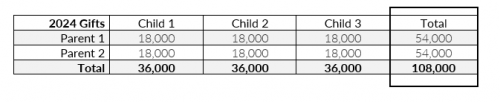

Contributions to a 529 plan are subject to the Annual Gift Tax Exclusion rules. The exclusion amount in 2023 is $17,000 to each donee, this will increase to $18,000 in 2024. Each taxpayer is allowed to make a gift up to the Annual Gift Tax Exclusion per donee each tax year before a Gift Tax Return would need to be filed. For example, if a couple with three children files a joint tax return, they can gift a total of $108,000 to their children’s 529 plans in 2024. To accomplish the maximum annual gift to each child, each parent would create a 529 plan for each child (resulting in six 529 plans). Once established, each parent would then gift $18,000 to each child, or $54,000 total, and each child would receive $36,000 in their 529 plan over the course of the tax year.

Additionally, there is a 5-Year Election option that allows for “Super Funding” of a beneficiary’s 529 plan. This allows a taxpayer to gift five years of the annual gift tax exclusion to a beneficiary’s 529 plan in a single year; meaning if an individual made the 5-Year Election in 2024, they could gift $90,000 to one beneficiary in 2024. Making this election does require that an Annual Gift Tax Return be filed by the taxpayer making the gift. The taxpayer would report the $90,000 as gifted during the tax year and note that it is a 529 5-year election on the gift tax return. If this election is made, the taxpayer cannot make additional gifts to the beneficiary’s 529 plan over the course of that five-year period (e.g., taxpayer could gift again in 2030 if they super funded in 2024).

How to Choose a 529 Plan

When determining what 529 plan you should establish for an individual, the plan should be based on the taxpayer that will be contributing. The taxpayer should make sure that they follow their state of residence guidelines, ensuring they are eligible to receive any tax deductions available to them, through their state. Every state offers at least one 529 plan, though some do not require the taxpayer to use their state 529 plan to receive the deduction.

After concluding whether a state sponsored plan is the best fit for you, consult your advisor or go online to compare various 529 Plans by state. This website provides all available 529 plans in your state and on plan comparisons that include expenses/fees for the plans, contribution minimums/maximums, investment options available in each plan, historical investment performance data, and other plan features.

Financial aid implications:

The financial aid impact of a 529 college plan depends on who owns the plan, so it’s important to plan ahead, especially when there is more than one 529 account. All schools that offer federal needs-based financial aid require students to complete the Free Application for Federal Student Aid (FASFA) to calculate the student’s Expected Family Contribution (EFC) for determining how much federal student aid the student may be eligible to receive. The lower a student’s EFC, the greater the financial aid eligibility.

Generally, a 529 plan owned by a dependent student or parent has less impact on financial aid eligibility than if owned by a grandparent or other family member, but this is where timing and advance planning are critical.

529 plans owned by a dependent student or parent are considered parental assets on the FAFSA and a maximum of 5.64% of parental assets are counted in the FAFSA. Qualified distributions from a student- or parent-owned 529 are not included as part of income for financial aid eligibility. Custodial accounts for minors established as a Uniform Transfers to Minors Act (UTMA) Account or a Uniform Gifts To Minors Act (UGMA) account, are considered student assets and counted at 20%.

It’s not uncommon for grandparents to fund 529 accounts for their grandkids and529 plans owed by a grandparent are not included in the initial FAFSA. Currently, any withdrawals from these third-party 529s will be treated as income to the student on the FAFSA in a future year and can reduce the financial aid amount by 50% of the withdrawal made for that future application.

Starting with the 2024-2025 school year there will be a simplified FAFSA based on the FAFSA Simplification Act passed in 2022. Under the simplified FAFSA, qualified higher education (QHE) distributions from accounts owned by grandparents or other individuals (e.g., aunts, uncles, or friends) are no longer reported as income for the student on the FAFSA.

Other 529 Plan considerations:

- Timing is everything: The 529 withdrawal must be used to pay for QHEE’s in the same year. You can ensure proper matching by requesting that the distribution from your 529 plan be sent directly to the school bursar.

- If you take too much money: If you take a 529 distribution and discover that your student doesn’t have enough qualified education expenses, there are two options: prepay next year’s expenses or roll over the excess into another 529 account if you catch it within 60 days of withdrawing the funds. Keep in mind that rollovers are limited to one every 12 months.

- Changing beneficiaries for 529 Plans: Each 529 account has one designated beneficiary, usually the student for whom the plan is intended to provide benefits; however, there are no tax consequences if you change the designated beneficiary to another member of your family. Likewise, you can rollover funds from one child’s 529 plan into a sibling’s plan without a penalty. The IRS allows one tax-free rollover of a 529 account per beneficiary in a 12-month period.

As you look at establishing or tapping into a 529 account, don’t be afraid to ask for advice from your financial advisor or CPA if you want to be sure about the best way to withdraw and apply these funds. The burden of proof for tax purposes is on the 529 owner, so it’s best to keep copies of all college payment statements and support in case you get audited.