February Market Update: Coronavirus and the Markets

The month of February 2020 saw equities achieve all-time highs followed by one of the most violent sell offs in recent memory. Equity markets were rocked in the last week of the month as fears of the coronavirus spreading beyond China were confirmed. Concerns over global supply chains were rampant causing investors to reset expectations for economic and earnings growth. There was a strong urge from investors to “do something, anything!” in response. As investment professionals, we are not immune to this impulse but trained to resist it.

Before we delve into the details of the sell-off and our view on its long-term implications, we think it appropriate to provide three important reminders:

- This is not just a financial or economic crisis but a humanitarian one. Just as we sympathize with those around the globe who have been affected by the coronavirus, it is human nature to fear that it could infect us next. That personal connection is heightened by the uncertainty over the spread of the disease. As difficult as it may be, when making investment decisions, it is important to distinguish between personal fear and financial risk and remember that well-diversified portfolios are designed to help navigate shocks such as this.

- We’ve prepared for this. While we did not know that a flu-like epidemic would take hold in China and spread globally, we fully expected the arrival of a market correction at some point in time. Diversification has always played an important role in our investment process for this very reason. This month was a reminder of why.

- Not all assets are the same. In the midst of a sell-off, it’s tempting to take broad-based portfolio action. However, different asset classes (and even holdings within the same asset class) have varying risks and opportunities. We are actively seeking those opportunities. It is important to evaluate each investment’s role in the portfolio independently and as a collective.

The Virus

With the risk of sounding like “arm-chair” epidemiologists, below, we share some of the data points that we are monitoring.

As we write this, there are currently approximately 88,000 confirmed cases of the coronavirus. Approximately 91% of those cases are in mainland China and 4% in South Korea. Both countries have taken significant measures to contain the spread. In China, where the first infection originated, the spread has slowed as a result. Nevertheless, some individuals traveled outside of China before the quarantines began, and concern has mounted that we could see cases outside China grow substantially. There are currently cases in 65 countries. Italy and Iran have seen infection totals rise significantly over the week. In the US, according to the CDC, there have been 70 reported cases. These numbers are likely to accelerate as more individuals progress through the 14- to 28-day incubation period (the time before symptoms show) and seek medical help. While the number of infected persons is an important data point, we are also paying attention to the virus’s geographic footprint: 10,000 cases contained to a single city in California, for example, is potentially less troublesome than 10,000 cases spread across several metropolitan areas.

The mortality rate of the virus is relatively low and, to date, seems more dangerous in older patients and those with already compromised immune systems. Thankfully, thus far, the mortality rate among otherwise healthy adults has been negligible and it has been mercifully low among children.

About 81% of cases manifest with only mild flu-like symptoms, and many individuals have been able to recover at home. About 14% of cases have been designated as “severe,” with patients developing pneumonia and shortness of breath. The mild symptoms experienced by many patients may serve to intensify the spread of the virus as those infected individuals may not self-quarantine because they mistake it for a common cold. Thus, we are likely to see an acceleration in infection rates outside of China for weeks or months to come.

The Economy

Developing test kits, vaccines, and treatments for the virus is currently the primary policy goal; however, strategies for containment are also a focus. Ironically, these containment policies are often more harmful to the economy than the disease itself. When a city or factory goes under quarantine, everyone is required to stay home not just those presenting symptoms. That serves to sharply reduce the production of goods and services. Parents may be required to stay home with children if schools are closed, foregoing wages.

Focusing on production or the supply side of the economy, it’s our current view that the impacts of coronavirus will delay rather than permanently impair most economic growth. The recent sell off began with the headline that Apple was reducing guidance for this year’s earnings due to slowing production and store closures in China. The argument supporting a transitory impact is that as factories come back online, those would-be shoppers will, in fact, buy their iPhone. This often results in a snapback in activity often referred to as a “V-shaped recovery” by economists.

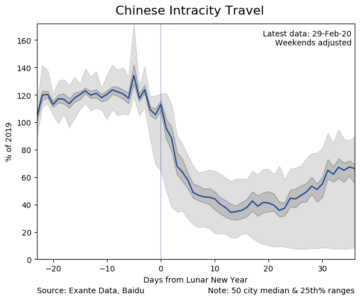

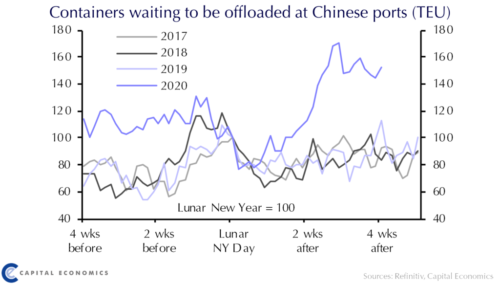

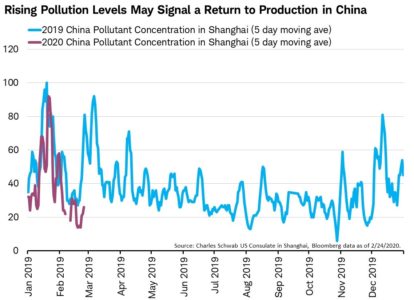

We anticipate improvements on the supply front as time goes on. Indeed, activity is beginning to pick up in China, albeit slowly. Intracity travel is down approximately 35% from 2019, which is a substantial improvement from the approximate 55% decline a few weeks ago. The number of shipping containers waiting to be offloaded is starting to come down. Pollution levels are also lifting off their lows as factories restart and increase demand for electricity and fuel.

While much of the early commentary has focused on the impact to the supply side of the economy, it is equally, if not more, important to evaluate the demand side. A sustained decrease in demand would considerably increase the probability of a recession. This begs the question, what if those people who couldn’t buy an iPhone this month are unwilling or unable to buy it next month? If demand becomes permanently impaired, then the recovery will look more like a “U” (wider bottom that takes longer to rebound) or an “L” (a bottom that is in place for much longer) than a “V.”

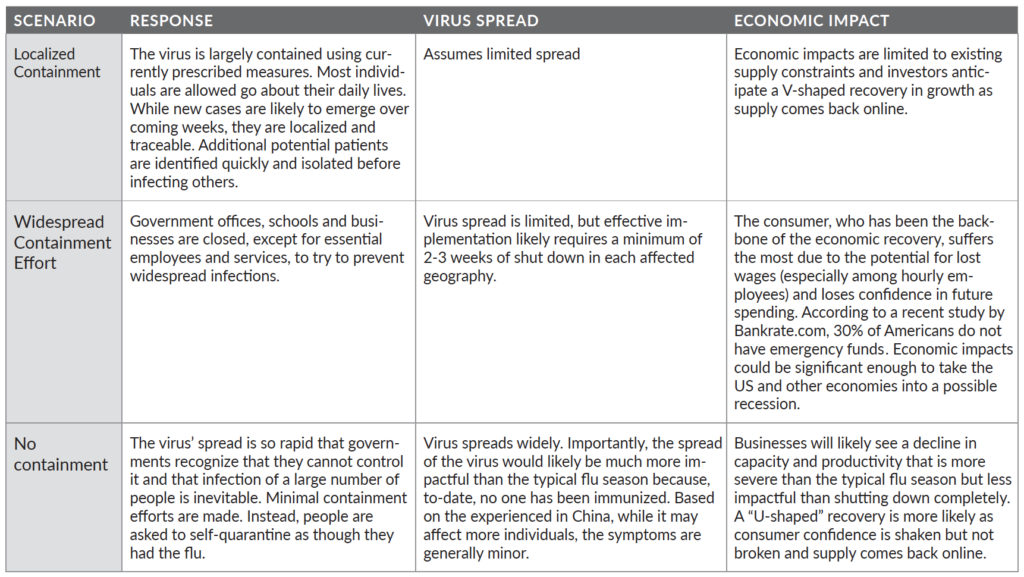

One of the most significant variables to assessing the potential for recession is policymakers’ containment response. We offer three possible scenarios:

Among the three, we see attempts at widespread containment as being the least likely initially. We anticipate an acceleration of new cases of coronavirus outside of China, but we are hopeful that disruptions to daily life and business activity can be minimized. Heightened awareness of the virus at this time should encourage individuals to take measures to protect their own health and safety.

Our base case is that the US economy experiences diminished (but not negative) growth over the first half of 2020 with the potential for rebound in the second half. While not part of our forecast, a combination of fiscal and monetary policies could lessen the impacts of (or even help to avoid) a recession caused by a fall in consumer confidence and demand which further supports our view that the downside risk from here remains somewhat limited.

Equities

Globally, history suggests that the equity markets can move meaningfully higher once the number of new cases has peaked. Consequently, the longer the virus continues to spread, the longer we should anticipate elevated levels of volatility. We are reminded, however, that volatility goes both ways. Positive developments involving vaccines, treatments, policy responses, and the number of new cases may cause an upward response from the markets while negative news may push the markets lower. Markets will likely react instantaneously to these developments giving investors little opportunity to adjust their positioning. As such, the best strategy for long-term investors is to ride it out or else risk realizing permanent capital losses.

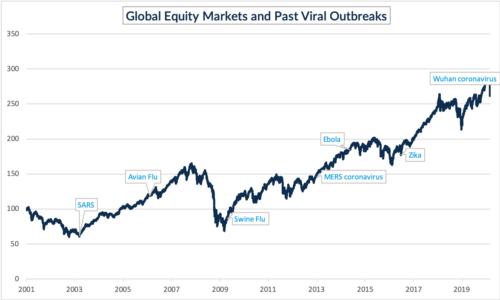

Global stock markets have proven over the long term to be resilient to past viral outbreaks. In the last 20 years, we have experienced seven major outbreaks of disease around the world. There are numerous reasons why this time may be different. The coronavirus is more easily transmitted and economies and supply chains are more interconnected than in the past. Contrarily, researchers have become more adept at developing vaccines and drugs to treat the disease. Therefore, we believe the markets resiliency to virus induced shocks should ultimately continue.

Fixed Income

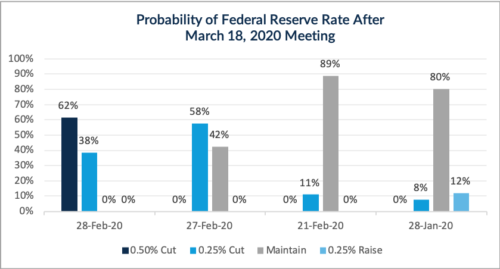

Bond market investors are assuming that the Fed (potentially in coordination with other central banks) will take action to support the economy and the markets. On Friday, Federal Reserve Chairman Jay Powell signaled a willingness to act, if needed. Bond markets are pricing in an approximately 38% chance that the Federal Reserve cuts benchmark rates by 0.25% and an approximate 62% chance of a 0.50% reduction. For context, just a month ago, markets had forecast a 92% chance of either no rate cut or an increase!

The Fed can help fight recessions caused by demand issues by lowering borrowing costs and spurring spending. However, the Fed cannot fix transitory supply chain issues. While it’s increasingly likely that the Fed will take some action, we have some concerns that the markets may be left underwhelmed.

Investors should also consider their exposure to corporate debt in this environment. We continue to recommend a high-quality bond portfolio to provide some ballast to riskier positions. Lower-quality corporate debt yields have risen materially over the past week. While these yields are not yet attractive relative to the risks, in our opinion, additional volatility may present opportunities for investors.

Portfolios

A well-diversified portfolio is designed to help dampen the impact of market volatility. At this time, we do not anticipate that the coronavirus will push the U.S. or global economy into a recession, though we are carefully and continuously monitoring the situation to determine whether a change in that view becomes necessary. The volatility (up and down) may continue for days, weeks, or even months to come. We are actively seeking to take advantage of some of the volatility by helping clients invest excess cash, rebalancing to portfolio targets where needed, and seeking new opportunities that can deliver long-term value to investors.