Economic Rehabilitation Not Without Setbacks

Surgery is scary but relatively easy work for the patient thanks to anesthesia. The hard work comes after the patient wakes up and starts the rehabilitation and recovery process. The economy awakening following relaxation of COVID containment measures reminds us of the patient opening her eyes and taking her first steps. It may feel momentous, but she has a long road ahead as she regains strength and adapts to post-op changes. September may have felt like a setback for the recovery, but arguably it’s a sign that we’re starting our prescribed rehab.

Economy

While the second quarter’s 31.4% decline in economic output marked the largest drop in modern history for the U.S. economy, the third quarter is widely anticipated to bring about a large rebound. However, the momentum is unlikely to stay quite so elevated.

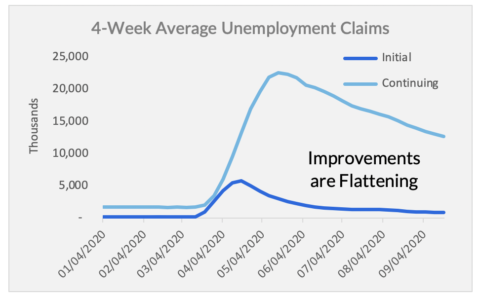

Source: Unemployment Charts: Department of Labor, FRED

Look no further than unemployment. We’ve seen significant declines in the number of Americans filing initial and continuing claims for unemployment benefits over the last six months. However, the momentum is slowing. The first wave of re-hires was relatively easy as firms brought back business-critical employees. Moving forward, we believe we will see a slower pace of job growth. As businesses reassess their needs, we fear that many temporary furloughs will become permanent layoffs. Unfortunately, finding a new job takes longer than returning to an old one.

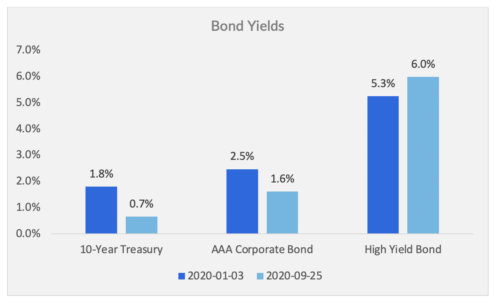

Bonds

Investing in bonds may also get more difficult from here. Bonds have had strong returns year-to-date, driven by price appreciation brought on by lower interest rates. This dynamic has effectively pulled future yields forward. Bondholders will need to take on incrementally more risk to offset the declines in yield on their portfolios. This requires in-depth credit analysis to gauge the likelihood of corporations and municipalities to meet their obligations. There’s income out there, but it will be more challenging to find it.

Source: Yields: ICE BofA US High Yield Index, 10-Year Treasury Constant Maturity Rate, ICE BofA US Corporate Index, FRED

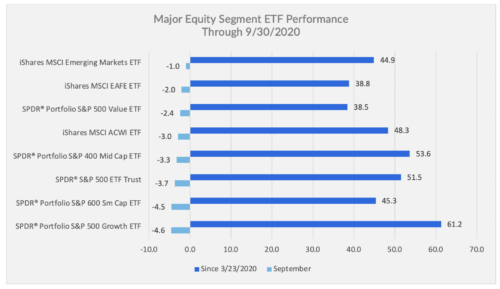

Equities

It’s not been hard to find return in equity markets from the March lows. Global equity markets are up nearly 50%. Even “weaker” segments of the market rose more than 35%. However, focusing on index performance overlooks the nuances between individual companies. For example, within the S&P 500 index, the top five stocks represent more than 20% of the benchmark’s market capitalization. These five companies are either in the technology sector or are benefiting from “stay-at-home” orders. Investors have not had to pay much attention to factors such as valuation or balance sheets to source returns. In September, that began to change.

Source: ETF Performance: iShares, SSgA, Morningstar

What’s Next

Just as the recovery from surgery is rarely without a bit of pain and discomfort, our economic rehabilitation may experience setbacks and frustrations. The good news for investors is that there are still opportunities to find return; the bad news is that we may need to work harder, and even look outside the current market leaders, to find them.