The Costs of U.S. Tariffs Imposed Since 2018

Editors Note: This analysis is being published in collaboration with EconoFact, a nonpartisan economic publication that created the following content.

The Issue:

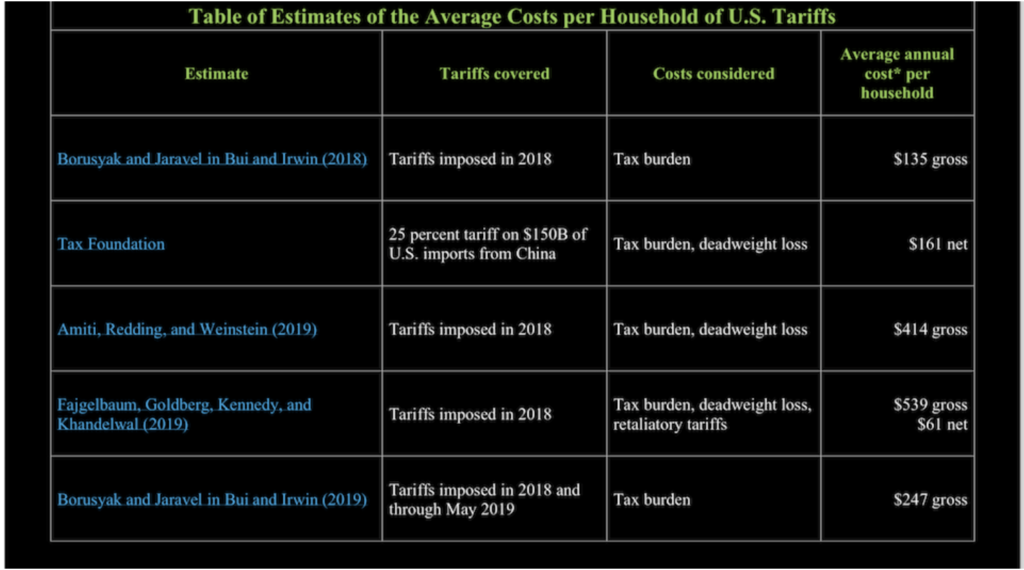

Economists from academia and the policy sphere have used a variety of methods to estimate the impact of new tariffs implemented in 2018 and 2019 on U.S. firms and households. Variation across emerging estimates reflects more than measurement issues. The costs imposed by tariffs go beyond the direct dollar-price increases resulting from these new taxes on targeted goods. There are efficiency costs and uncertainty about their future path. Tariffs also may benefit protected sectors of the economy and are a source of government revenue. The evolving range of estimates depends on which costs and benefits are taken into account. Estimates of the average gross annual cost of tariffs levied in 2018 through the first half of 2019 tend toward $800 per household. Estimates of net costs vary more widely. When setting aside policy uncertainty, they vary from about $60 to $500. The latest studies suggest the combination of new tariffs and increased trade policy uncertainty create a substantial drag on the economy as a whole: net losses projected for 2020 are between about $500 and $1700 per household.

(Click here for a larger version of the table with a complete listing of studies mentioned, their estimates, and the different factors each study takes into account.)

The Facts:

- A tariff is a tax imposed on goods that the U.S. buys from other countries. An important part of the cost of the tariffs for U.S. households and firms consists of the tax incidence — the portion of the tax that is passed on to various buyers and sellers of targeted goods once they arrive at the U.S. border. One study finds that the group of tariffs levied only during the year 2018 would raise the cost of the consumption bundle for the average household by $135 dollars (see this table for a summary of all studies mentioned, their estimates, and the different factors each study takes into account). An update by the same authors estimates the costs of tariffs imposed in 2018 and through June 2019 will cost the average U.S. household $247 per year, or $460 per household per year when including those planned through December 2019.

- Beyond adding up how much U.S. buyers expend on tariffs, or which buyers bear the greatest incidence, an accounting of the full costs of the tariffs should include the fact that the taxes also generate efficiency losses. Households and firms may have to substitute away from goods targeted by the tariff toward alternatives that cost more than they were paying before, or that are less well suited to their needs or preferences. Some buyers at the margin may find that they are no longer able to afford as much of the good, or may decide to go without it. These broader costs, called “deadweight loss,” may be between half and 3 times the direct burden of the tariff (see here for a concise breakdown of tariff payments versus deadweight loss). Two studies find that the cost of tariffs levied only during the year 2018, including both the direct cost and the deadweight loss from the tariff, totals $400 to $500 (see Fajgelbaum, Goldberg, Kennedy, and Khandelwal (2019) and Amiti, Redding and Weinstein (2019) in the table). Two studies estimate that the cost of tariffs levied in 2018 and the first half of 2019, including both the direct burden and the deadweight loss, amounts to roughly $800 per household (see here and here, also in the table).

- Tariffs can result in diffuse price increases that are difficult for researchers to measure with precision in real-time. Academic research suggests — and companies have announced — that firms whose costs are affected by tariffs may spread theses costs across goods that were not targeted by the tariff. The objective may be to minimize the number of goods exhibiting a large retail price hike, which can disrupt sales volumes. However, this type of strategic pricing also may enable stores to pass on a higher fraction of the costs. Domestic producers in U.S. industries protected by tariffs (as well as foreign producers not subject to the tariffs applied to Chinese goods) may also raise prices on their goods in the U.S. market, adding another layer of complexity in measuring the overall impact on prices for consumers. Production of some goods may be flexible enough that a tariff on varieties from only one country will have no effect at all. Economists are still studying exactly how much the changes in the prices of targeted goods as they cross the border translate into prices charged to the final purchasers as opposed to being absorbed by firms and distributors as losses on the supply-side

- The trade policy uncertainty can affect the investment and hiring decisions of firms, slowing economic activity. Tariffs have been introduced rapidly; their ultimate size, scope and duration is as yet unknown; and the range of retaliatory tariffs is likewise evolving. All of these issues present uncertainty, introducing an additional risk in investing and hiring because firms may find it harder to anticipate the costs of imported inputs or the scope of their export market. This results in the economy growing less than it otherwise would. The Congressional Budget Office estimates that combined with the deadweight losses from tariffs, policy uncertainty will cause U.S. gross domestic product to be 0.3 percentage points lower in 2020 than it otherwise would be. The Federal Reserve Board of Governors, using a more detailed measure of trade policy uncertainty, estimates that GDP will be a full percentage point lower in 2020 than it otherwise would be, driven by disruption in investment and industrial production. These two studies suggest these losses will amount to between $500 and $1,700 per household on average in 2020 alone.

- Some studies account either explicitly or implicitly for increased profits and wages in industries protected by the new tariffs and for tariff revenues as a source of government revenue. While the imposition of tariffs may make the economy less well off in general, this does not mean that it is a loss for everyone: tariffs generate gains for some firms. For instance, protection from foreign competition allows some firms to raise their price — increasing their profits and the wages they are able to pay. Like other taxes, tariffs also are a source of government revenue. Taking this into account can affect estimates of the overall cost of tariffs: one study that includes these factors (but does not include the broader uncertainty) finds net effects from the 2018 tariffs as low as $61 per household per year, on average. The empirical approaches by the Congressional Budget Office and the Federal Reserve Board of Governors implicitly allow for some benefits to be factored in, but still find net losses from changes in trade policy (with uncertainty) through June 2019 of roughly $500 to $1700 per year in 2020, averaged across households.

- Most studies assume substantial pass-through of the tariffs into the prices that households and firms pay for targeted goods. Studies of the first year and a half of the new tariffs suggest that the entire cost of the tariffs did, indeed, appear in the prices of goods targeted for tariffs as they crossed the border into the United States. The substantial pass-through of tariffs observed in prices of targeted goods as they cross the border may indicate, in line with previous research, that because a lot of U.S. trade with China is invoiced in dollars, prices of U.S. imports from China are sticky in dollars. Depreciation of the Chinese Renmimbi (RMB) against the U.S. dollar over time may offset some of the direct cost of the tariffs for importers. Adjustments in the prices in response to exchange rate fluctuations when prices exhibit stickiness can sometimes take 1-3 years, depending on expectations. Exchange rate adjustment is not a panacea. It does not eliminate all deadweight loss from the tariff because tariffs still distort the prices of goods targeted by the tax relative to goods not targeted. Exchange rate adjustment also does not eliminate the effects of the new policy uncertainty, which may be much larger than the more direct costs of the tariffs.

What this Means:

Economists across academic and policymaking institutions have produced a number of different estimates of the impact that changes in trade policy since the start of 2018 have had on the U.S. economy. The lowest estimates involve only the direct incidence of the new taxes on consumers. The highest estimates include the direct costs of the tariffs, costs related to distortions the tariffs generate in firm and household behavior, and the drag on firm activity that increased uncertainty about trade policy has brought. Taking the full range of estimates into account, the new trade policy regime implemented in 2018 through June 2019 is likely to result in an average cost per U.S. household between $500 and $1,700 a year.