Colony Market Update – COVID-19 Impact

People are gripped with fear. We fear getting sick, losing our jobs, and watching our portfolios decline in value. That is a very understandable reaction to the crisis in which we currently find ourselves.

Professional investors channel that fear into analysis. They analyze everything from economic growth, corporate earnings, virus reproduction rates, virus mitigation efforts, fiscal and monetary policy, and the investment markets. This analysis generally works when markets are behaving rationally. Last week, however, we began to see signs that panic was taking over. This is understandable considering what transpired this past weekend. We got our first sense of what “social distancing” feels like in the extreme with the announcement of new guidelines including lockdowns and quarantines. Grocery store shelves were left bare, schools were cancelled, and businesses scrambled to find ways to support their communities while protecting their businesses.

What has changed?

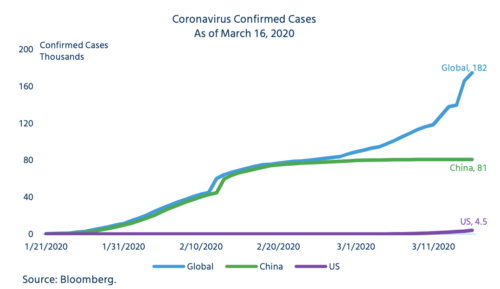

The rapidity at which the virus has spread is extraordinary and spotlights the fluidity of the resulting crisis. Governments around the world are taking significant action to “flatten the curve” in order to slow the virus’s spread. As we digest what that means for business activity, it now seems a foregone conclusion that both the world and the U.S. will fall into recession. Indeed, the current effective halting of our economy caused by these efforts could lead to an economic contraction that is more severe than during 2007-2009. We believe, however, that any recession should be shorter in duration. We have seen evidence in China that containment efforts can be successful and that, afterwards, economic activity can resume. As the curve has flattened, in China, activity has begun to return to normal:

- Starbucks and Apple stores have reopened

- Cargo ships are being unloaded

- Coal consumption is increasing

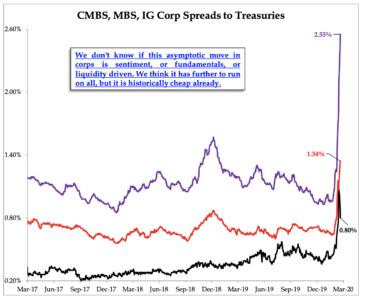

Over the last week, we have also seen signs that an impending economic contraction is causing pockets of instability in the financial markets. We are all very familiar with the volatility in the equity markets, with 1,000+ point moves from the Dow Jones Industrial Average (both up and down) occurring several times.

We also began to see signs of stress in the corporate bond, municipal bond, commercial paper, repurchase agreement (repo), and money markets. Most of these dislocations are the direct result of borrowers proactively sourcing liquidity anywhere they can while investors are pulling money out of investments with credit risk. This has resulted in widening credit spreads (the yield that an investor demands above risk-free Treasuries). We believe that our Federal Reserve has the tools and resources to make sure these markets remain liquid. It has dusted off its playbook from the financial crisis by offering a $1 trillion emergency lending program for the commercial paper market, reducing the interest rate and duration of loans made to banks through its discount window, cutting interest rates by a total of 1.5 percentage points, and announcing plans to purchase $700 billion worth of Treasuries and mortgage–backed securities. A headline from a March 15th article in the New York Times said it best, “The Fed Deployed Its 2008 Arsenal All in One Weekend.”

Source: Strategas

2020 vs 2008

Many pundits have started comparing the current crisis with the Great Financial Crisis. While there are certainly aspects of today’s crisis that resemble 2008’s, we believe the differences outweigh the similarities:

- The current crisis was not caused by a bursting asset bubble. Recall that the Great Financial Crisis began with a housing bubble. While the equity markets may have been somewhat rich at the beginning of 2020, there weren’t many readily identifiable signs of speculative excess. This is important since bursting bubbles tend to have a longer lasting impact. For example, after the Great Financial Crisis, real estate took about 10 years to recover to pre-crisis levels. There is little concern today that the virus will last for 10 years and/or that company earnings or credit markets will take that long to recover.

- Economic growth was improving coming into the current crisis. That is no longer the case, as the economy should decelerate sharply over the next several months. Yet, policy makers have responded much more proactively this time around in an attempt to reinvigorate growth and support those sectors and businesses that are hit the hardest. We have already reached the zero bound on the Fed Funds Target Rate and, as we write this, the administration is proposing a $1 trillion–plus spending package featuring $1,000 checks to individuals. It took policy makers several months in 2008-2009 to make similar moves that today are happening in days.

The spread of the virus ultimately is expected to subside. As such, we expect the economy should experience a snap–back recovery of an unknown magnitude once social distancing and lockdowns end. For example, while we believe that unemployment may spike over the near-term, anecdotal evidence suggests that many businesses are working hard to keep employees at the ready to come back once things get back to normal.

Where do we go from here?

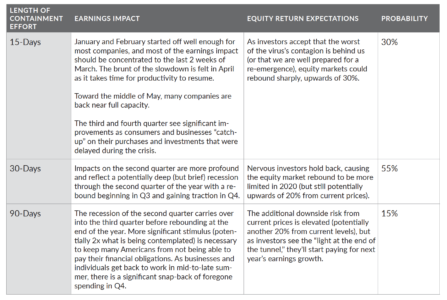

Clearly, public policy has shifted to “widespread containment efforts,” which we discussed in one of our previous communications. While we hope these efforts will succeed in containing the virus’s spread, we believe its economic impact is likely to be significant. Businesses are forced to limit or halt work and consumers are shaken as their own employment picture gets more uncertain by the day. The length of the containment efforts is the biggest factor in how quickly companies (and thus the equity markets) recover. We offer three possible scenarios and our expected probabilities of each. The higher weights to the 15-day scenario and the 30-day scenario reflect that we anticipate containment efforts to ramp down (shifting to a focus on higher–risk citizens) as time goes on.

What Are We Doing?

In our communication at the beginning of the March, we provided three reminders:

- This is not just a financial or economic crisis but a humanitarian one. We must distinguish between personal fear and financial risk and remember that your portfolios are designed to help navigate shocks such as this.

- We’ve prepared for this. Diversification and prudent asset allocation have always played an important role in our investment process for this very reason.

- Not all assets are the same. They each have varying risks and opportunities. Consider each investment’s role in your portfolios independently and as a collective.

Over the coming weeks, clients may see a number of actions taken in their portfolio that align with these reminders:

- For taxable accounts, we are harvesting losses to offset the taxes owed on future gains while maintaining market exposure.

- We have identified certain money market funds that, in the current environment, are no longer offering yields that compensate for the relative level of risk. While we do not believe these funds carry excessive risk, we are taking action to switch into even safer funds.

- We are evaluating portfolios to assess the need to rebalance them back toward their strategic targets, as developed during the financial planning process.

- For our opportunistic clients, we are taking advantage of the market disruptions to invest excess cash and identify new investments that can deliver long-term value to investors.

We do expect the volatility to continue as investors grapple with the uncertainty in the markets. Nevertheless, our stewardship of our clients’ capital impels us to prepare for a likely rebound in the same way that we have prepared for bouts of volatility – through proactive portfolio management, a steady hand, and prudent diversification. As always, please reach out to us if we can be helpful in anyway – personally or professionally – as we tackle this latest crisis together.