How Business Owners Could Reap Big Tax Savings

If you are a sole proprietor, a shareholder or member of an S-Corp, Partnership or LLC, including publicly traded partnerships, or if you own rental real estate, you may qualify for new deductions that could mean significant tax savings. The 199A deduction, part of the Tax Cuts and Jobs Act of 2018, allows a deduction of up to 20% of qualified business income. Many business owners may now be able to pay taxes on only 80% of their income? Sweet deal, right?

While the deduction is undoubtedly taxpayer friendly, it is also extremely complicated with a whirlwind of definitions, phase-outs and phase-ins. Coupled with the complexity of the new law are unanswered questions and undefined terminology. While we’re waiting on additional guidance from the IRS, there are many things that you should consider now. So, let’s dive a little deeper into what this deduction is all about.

What is the 199A deduction?

199A allows a deduction for 20% of “combined qualified business income.” The deduction is available for individuals, trusts, REITs and Co-Ops. It’s a big deal.

Qualified Business Income (QBI) is the net amount of qualified items of income, gain, deduction and loss with respect to any qualified trade or business. Each activity’s QBI is computed separately, and then, all the QBI amounts are added together to arrive at combined QBI.

Who is Eligible?

A qualified trade or business. Generally speaking, a qualified trade or business is any trade or business that is not a specified service trade or business (but see taxable income exception below), or the trade or business of performing services as an employee. This brings up two questions: What is a trade or business and what is a specified service trade or business?

While the QBI deduction is computed at the owner level, the determination of what constitutes a “trade or business” is made at the entity/activity level. So it doesn’t matter if you are an active or passive owner. So what is a trade or business? Well 199A doesn’t define it. For now, we have to look to the current tax code and case law. Many practitioners, including yours truly, don’t think any definition will be provided by the IRS. Instead, it may fall on clients and practitioners to determine what qualifies based on the facts and circumstances.

Special Circumstances for Specified Service Trade or Business

A specified service trade or business includes the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any other trade or business where the principal asset is the reputation or skill of one or more employees. Engineering and architecture have been specifically carved out and identified as not a specified service. We definitely need more specific guidance from the IRS on what businesses actually fall into the specified service category.

Generally speaking, the income from a specified service trade or business does not qualify for the QBI deduction, but there is an exception where taxable income is below $415,000 married filing joint and $207,500 for all others. Tax planning is a must-do for service businesses that could potentially meet this exception.

What About Rental Real Estate?

Rental real estate, whether residential or commercial, is generally not considered a trade or business unless you are a real estate professional. While it is clear that Congress intended rentals to qualify for the deduction, remember, the deduction is only allowed for a qualifying trade or business. So, when does a rental activity rise to the level of a “trade or business”? Right now the IRS has not put out any guidance on this question, so we don’t know for sure. If you asked five different tax advisors, you would likely get 5 different opinions.

Here’s How it Works:

No matter what kind of business you have, if your taxable income is below a minimum threshold, you will receive the maximum 20% deduction (subject to the overall 20% of taxable income limitation mentioned later). The threshold is $315,000 married filing joint and $157,500 for all others. Once taxable income reaches this threshold, the allowable deduction gets much more complicated. But don’t give up on the deduction if your taxable income exceeds these amounts. Under the right circumstances, everyone with QBI can take the deduction.

Phase-In: Beginning at $315K/$157.5K of Taxable Income

The phase-in was put in place to limit the deduction for businesses who have small amounts of W-2 wages and tangible property compared to their QBI. The Phase-In applies to all businesses when your taxable income falls in the range of $315,000-$415,000 ($100K Phase-In) married filing joint and $157,500-207,500 ($50K Phase-In) for all others. Once you are within the Phase-In range, you have to start looking at your allocable share of W-2 wages and basis in qualified property related to the same activity. Specifically, take the greater of

- 50% of your allocable wages or

- 25% of allocable wages plus 2.5% of unadjusted basis of qualifying property

If this amount is greater than or equal to your initial 20% QBI deduction, you still receive the full deduction. If this amount is lower, the phase-in will reduce your allowable QBI deduction.

The phase-in is different than a phase-out. As we’ll see below with the specified service trade or business, once you are 100% phased-out, you no longer get a deduction. This is not necessarily the case with the phase-in. You can be 100% phased-in (assuming a non-service trade or business), and still receive a deduction as long as you have allocable W-2 wages or property.

The phase-in is applicable to both service and non-service businesses. On top of the phase-in, specified service trades or businesses are also subject to a phase-out that may wipe out the entire deduction.

Phase-Out: Service Businesses Get Hit Twice

If you have a specified service trade or business, you are subject to the phase-in mentioned previously, and you are also subject to a phase-out of the deduction with the same threshold range. Once taxable income reaches $415,000/$207,500, the deduction is 100% phased-out. Your deduction is zero.

Combined QBI and the Overall Taxable Income Limitation

Once you navigate your way through all of these rules for each activity, add-up all QBI from all activities (service and non-service). This sum equals the combined QBI. If the combined QBI is negative, this carries over to the next year to offset future QBI. Whether this “loss” carries forward for more than one-year is another unanswered question.

If your combined QBI is positive, there is one last limitation. The combined QBI cannot exceed 20% of your taxable income. Taxable income in this context is defined as taxable income less qualified dividends and long-term capital gains taxed at favorable rates.

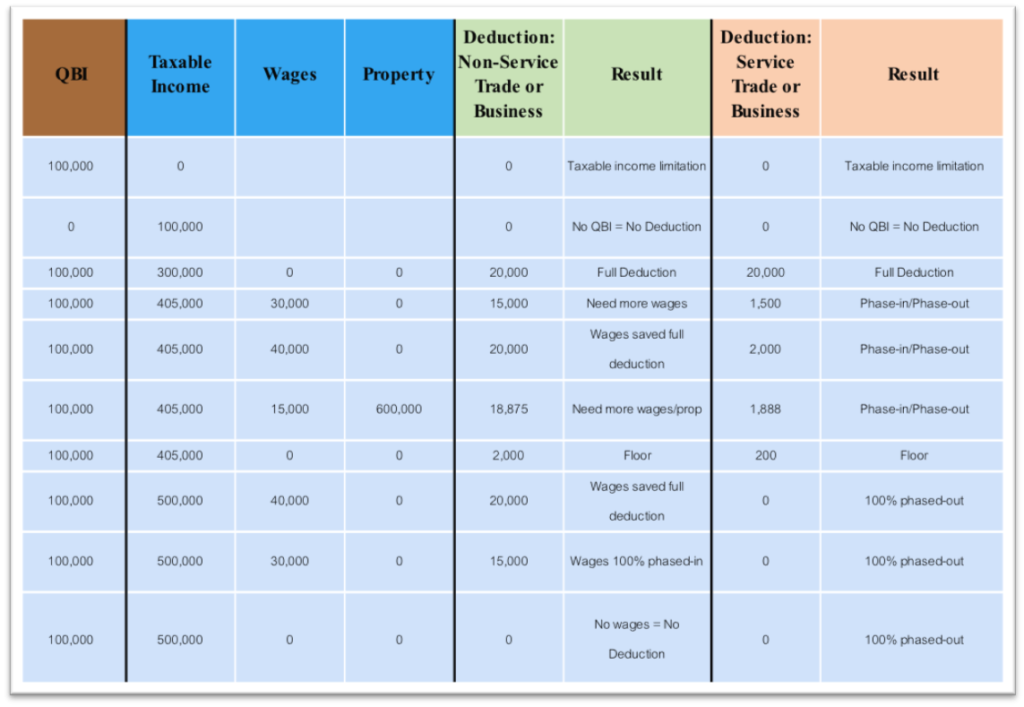

Below is a chart demonstrating the QBI deduction under various scenarios.

The Bottom Line

It goes without saying (but I’m going to say it anyway) that this new code section is extremely complicated. Every situation is unique, so careful analysis must be done to identify QBI and plan ahead to maximize the deduction. This is especially true for taxpayers with a specified service trade or business where taxable income could potentially fall below the maximum phase-out. Despite all the unanswered questions, there may be planning opportunities that can be implemented now to put you into a more favorable tax position for 2018.

Our tax services group is dedicated to helping you understand and work with the 2018 tax law changes. Feel free to reach out to us and get the planning started!

In our next article, we will focus on tax planning strategies to maximize this valuable deduction.