Bear Market Depressive Syndrome

The psychology of a bear market is radically different from that of a bull market. In a bull market, it is good old-fashioned greed, unbridled avarice that is the culprit. With it, we get megalomaniacal and drunk with power. We omnipotently think our wisdom accounts for our success. That is how Wall Street coined the saying, “Never confuse a bull market with genius.”

Unlike greed, which begins subtly and builds momentum on an unconscious level, fear and anxiety are the dominant emotions in a bear market and they smack you right in the face and gut. As the market drops further, the two quickly give way to panic! Panic destroys all rational thinking.

Now, at a deeper level, we are experiencing what I call the Bear Market Depressive Syndrome (BMDS)! Its symptoms are the following: Loss of control – The megalomaniacal omnipotence experienced at the height of the bull market surrender to a feeling of powerlessness and helplessness; Shame- The pride of success so flush in a bull market is replaced by a great sense of failure and shame; Guilt- The investor is haunted by “should haves.” I should have sold last year, I should have sold higher, I should have sold everything, and so on; and, Low self-esteem- The inner cohesion and sense of self, so essential to mature functioning, is destroyed by shame and the feeling of a loss of self-control. In its place stands a weak and vulnerable sense that retreats to self-doubts and paranoia.

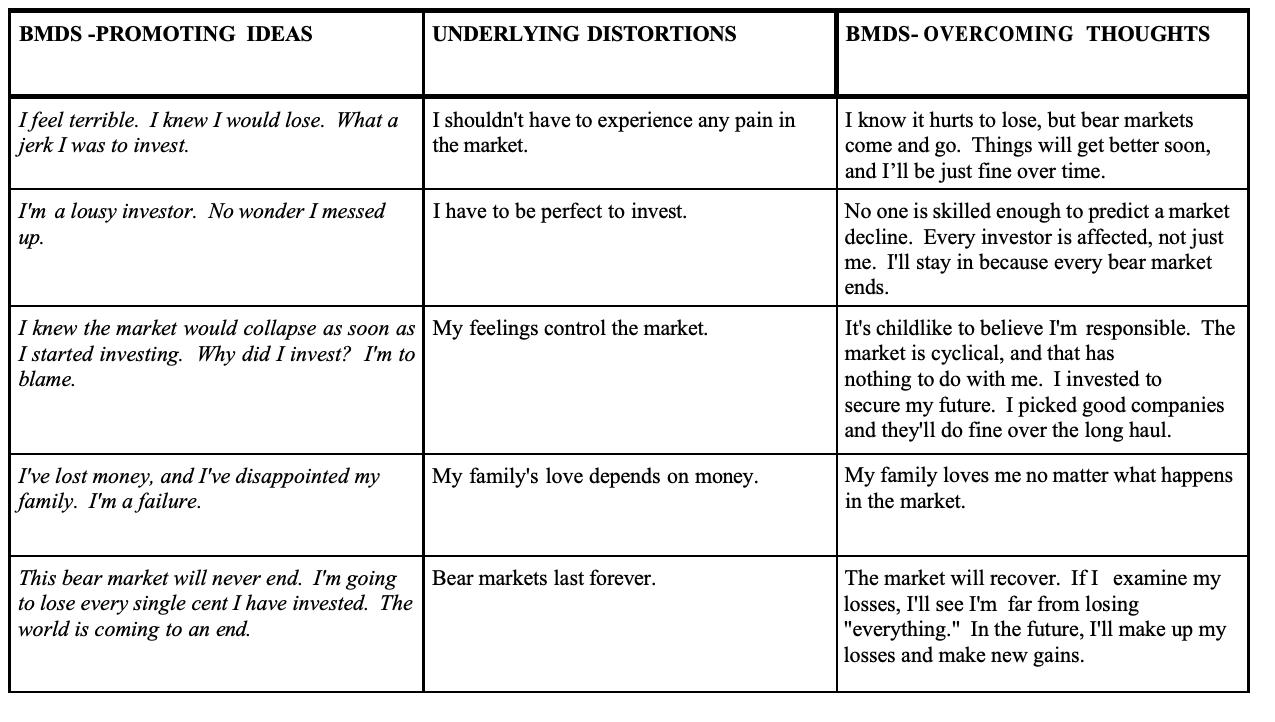

Bear markets and every BMDS are like the preceding ones, but also has its own unique characteristics. Our anxiety has been heightened. It results in less stability, which stresses the BMDS. Under the influence of the BMDS, an investor cannot think clearly. A successful way to try to counter its sway is to borrow techniques employed by cognitive therapists to battle depression. The distorted thinking of the BMDS must be replace by reality-based thinking. The remaining problem is how to invest until it is clear that the bear market is over. Investors may want to follow some of these strategies:

- Try to maintain a higher than usual level of cash to help take advantage of the inevitable opportunities that result.

- Identify attractive, undervalued stocks, and nibble at them through a dollar-cost averaging approach.

- Emphasize dynamic, financially strong companies that pay solid, often increasing, dividends.

- Every bear market has strong sectors.

- Finally, never forget: a bull market follows every bear market.

The following table, and a discussion of BMDS, taken from John Schott’s book, Mind Over Money. (pp.97-101, Little Brown, New York, 1998) illustrates this technique and will help to allay your fears and anxiety. Practice the technique and you’ll be surprised how much it will help.