529 Planning

The time has come! You want to start saving for the education of your child, grandchild, or even yourself. But what do you need to know about saving through a 529 plan?

The answer? A few things:

- 529 Basics and Tax Advantages

- What 529s can be used to pay for (e.g., what expenses are “qualifying?”)

- How much to save

- The differences between State-sponsored and Advisor-sold 529s

- Investing in a 529 Plan

There’s a lot to know, but don’t worry – everything you need to know is right here. Let’s dive in!

529 Basics and Tax Advantages

In short, a 529 Plan is:

- A tax-advantaged account,

- in which you can invest your money,

- to save for the education of yourself or another.

There are two potential tax advantages that make 529s such a power savings vehicle:

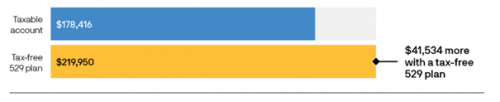

1. First, when used for qualifying educational expenses, your investment gains are tax free. This represents the most significant tax advantage of using a 529 plan relative to a taxable brokerage account. (In a taxable brokerage account, you have to pay taxes on gains, dividends, and income. In a 529 account, you don’t.)

2. Second, depending on the state you live in, your contributions may be eligible for a state tax deduction. For instance, in Massachusetts, up to $2,000 of contributions can be deducted from your state taxes in the year you make the contribution.

What can 529s be used to pay for?

529 assets can be used at any college or university (including some international). The one caveat? In order for you to use them without paying tax on the distribution, you must use them for a “qualifying” expense.

Qualifying expenses include but are not limited to*:

- Tuition

- Fees

- Room and board

- Computer equipment

- Books and supplies

- Up to $10,000 toward student loan principal and interest of a beneficiary or sibling

- Up to $10,000 per year per beneficiary for tuition at an elementary or secondary school. (While this is federally allowed, some states may claw back any tax deductions taken on these withdrawals, so check with your tax professional(s) or advisor to make sure you understand your state’s laws.)

*See the end of this article for more information on qualifying and non-qualifying expenses.

How much should you save?

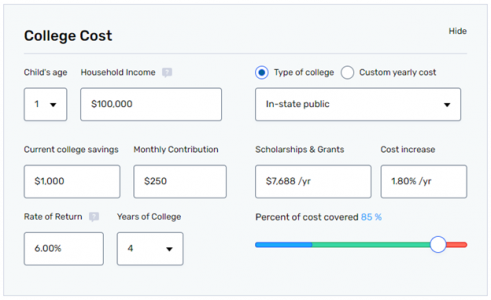

One way to create a savings goal is to estimate your expected tuition costs using an online tuition calculator. Tuition calculators let you adjust several variables to account for a variety of potential circumstances. For instance, you can stipulate that you want to know the cost at an average four-year, in-state institution in 18 years, assuming annual tuition inflation of 3% between now and then. You can then prompt it to show you how much you need to save on a monthly basis in order to save that amount (including your current savings if you aren’t starting from zero dollars), and assuming whatever investment return you would like to input.

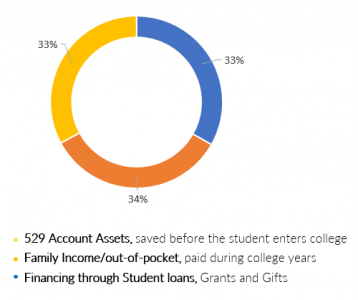

Do you need to save all of it in a 529 Plan?

You certainly do not. One common approach is to break the total cost of tuition into three pieces. In this scenario, you would try to save 1/3rd of expected college expenses in a 529 plan and then cover the rest using a combination of financing and out-of-pocket payments during college years. That may make saving more manageable if the monthly figure you got from a tuition calculator is a bit too ambitious.

The Difference between State-sponsored and Advisor-sold 529s

OPTION 1: Direct-sold, “state-sponsored” 529 Plans

• Direct-sold plans are purchased directly from the state agency running the 529.

• Almost every state (except Wyoming) offers a state-sponsored 529 plan.

• Depending on state, contributions may be tax deductible. Check the tax deductibility of contributions in your state by clicking here.

• Expenses (the cost to manage your 529 assets while they grow), also vary by state, so be sure to check the cost of each state plan by contacting the custodian of the plan in yours.

• Often, the cost is embedded in the expense ratio of the funds available for use in the plan. You can usually find this information on the state plan’s website.

OPTION 2: Advisor-sold 529 Plans:

• Advisor-sold 529s are opened with the help of a financial advisor.

• These plans often include commission costs that are avoided when using Direct, State-sponsored plans.

• A potential advantage of using an Advisor-sold plan is the advisor can select and manage the investments for you.

• A potential drawback is that the costs can be higher; you may pay a commission and the fund expenses may be higher too.

Investing in a 529 Plan

Finally, you will need to select investments, but which ones?

In any 529 plan, you will have access to a broad array of options that often include index funds, actively managed investments, and asset allocation models like age-based plan.

Generally speaking, there are two ways to invest your 529 savings:

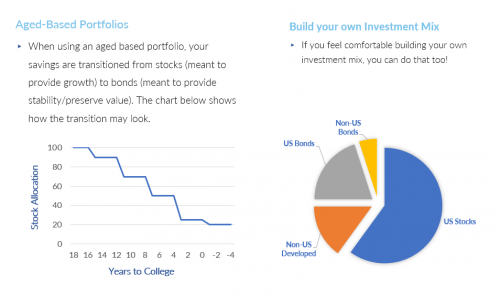

- You can use an age-based portfolio, also known as a diversified mix of investments that changes automatically over time — more aggressive at first to grow, then more conservative later to stabilize the value so that maximum funds are available at the age the beneficiary needs them.

- You can build your own investment mix by selecting different investments from the available options in your plan and managing your selections over time.

Here is an illustration of both options.

529 Flexibility

Here are a few more details about 529s to consider:

- You can change the beneficiary at any time to another qualified member of the current beneficiary’s family or yourself.

- You cannot change the owner of most 529 plans as it can result in financial aid implications. Who owns the account matters when it comes to accounting for the parent’s assets during the financial aid process (another piece of your savings plan). Assets, like Uniform Transfers to Minors Act (UTMAs) held in the student’s name are assessed at a flat 20% but funds in the parent’s name are assessed at a lower rate (no more than 5.64%).

- Grandparents listen up! Any 529 plans owned by someone other than the student or the student’s custodial parent is not reported as an asset on the Free Application for Federal Student Aid (FAFSA); however, the distributions count as untaxed income to the student on the subsequent year’s FAFSA that can reduce aid eligibility by up to half of the distribution amount. Because of this, your advisor may recommend the funds from these non-custodial parent 529s be used in the final two years of higher education to maximize the opportunity for aid.

- Thanks to the Secure Act 2.0, 529 owners can rollover unused 529 dollars into a ROTH individual retirement account starting in 2024. This is tax and penalty free as long as the 529 has been in place for at least 15 years; there is a lifetime limit of $35,000 per beneficiary.

Summary

To recap, here are the steps to start a 529 Plan.

- Pick a 529 Plan:

- To find your state-sponsored 529 Plan and check the tax deductibility of contributions in your state, use the following link: Tax Deductibility Information

- If there is not a state tax deduction incentive, there’s no reason to limit your options. All 529s are available to all U.S. citizens. Ask your advisor to help you select another state plan that may have a better performance history and/or lower expense ratio.

- Determine how much you want to contribute. Consider various funding sources, and estimate total education costs using the following calculator: Savings Calculator

- Open an account, make a contribution, select and monitor your investments (or ask for help from a professional advisor), and watch your investment in your loved one’s educational future grow!

Hopefully, our overview has helped demystify what can seem like a daunting task—affording the cost of higher education. As always, the advisors at The Colony Group are here to answer any questions or concerns you may have. You can reach out on our website or to Nicole directly at nicole.steinwedell@thecolonygroup.com.

Qualified 529 Expenses (QHEEs):

- Tuition:For full-time and part-time students at an accredited institution.

- Room and Board: On-campus/dormitory room and board is a qualified expense. Off-campus housing and meal costs are eligible up to the college’s published allowances in their “cost of attendance” figures, typically found on the school’s website or financial aid office. 529 funds used to pay for rent or meals in excess of the allowances published by the college’s annual cost of attendance are not a qualified expense.

- Fees:All fees, such as lab and technology fees, required by the school.

- Books and Supplies:Required textbooks, lab supplies as well as basic supplies such as pens, paper, printer ink, etc. are qualified expenses.

- Technology:Computers, iPads, printers, internet service, and required educational software used by the 529 beneficiary while enrolled in college are qualified expenses.

- Additional expenses of special needs beneficiaries:Certain services and equipment that a special needs student would require like wheelchairs and transportation costs that are generally considered a non-qualified expense are eligible in this case.

Non-Qualified 529 Expenses:

- Transportation and Travel: You cannot use 529 funds for transportation of any kind, including airfare, gas, and certainly not to buy a car to get to and from college. This includes travel for move-in/out purposes, holidays, etc.

- Insurance:Health insurance and medical services, even though they may be billed by the university, are not a qualified education expense.

- Student Loan Repayment: You cannot use 529 funds to repay any of your student loans. Make sure you use as much of your 529 savings to pay for your college expenses up front to avoid taking out unnecessary loans.

- Cell phones and other electronics:Cell phones, cell phone plans, and electronics for personal use are not eligible.

- Fitness club and activity fees including fraternity and sorority membership dues: All of these expenses are considered extracurricular (non-educational) and not eligible.

- Lifestyle and personal expenses: Mini refrigerators, laundry, and personal expenses are all not eligible.