3 Tips for Investors on Understanding Reported Earnings

As earnings season is underway for the second quarter of 2016, companies will report to investors how much they earned in the just closed quarter. Sometimes the most important information is not what management highlights but what they may choose to ignore when calculating earnings. This stems from the use of GAAP (Generally Accepted Accounting Principles) to calculate earnings per share. To get from revenue down to earnings, there are a number of accounting rules and managerial leeway that determine what costs are incurred and how they are reported. As famed investor Ben Graham noted, “The more seriously investors take the per-share earnings figures as published, the more necessary it is for them to be on their guard against accounting factors of one kind and another that may impair the true comparability of the numbers.” So, what is the big difference and what should investors know?

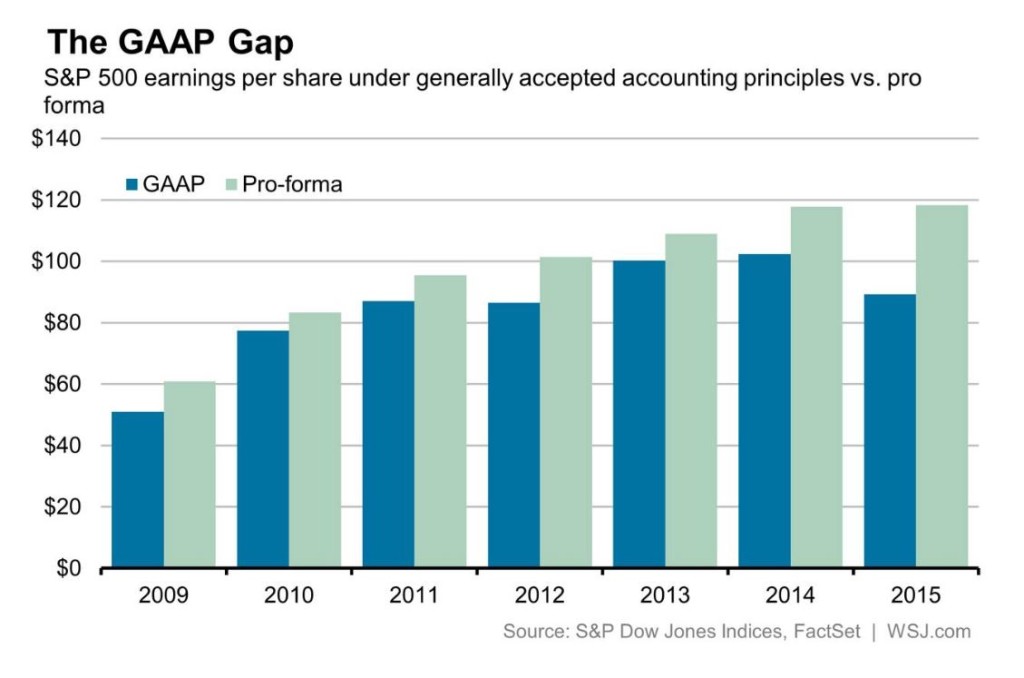

- Should investors mind the non-GAAP gap? Many companies provide pro forma (non-GAAP) earnings that can exclude some important costs. While not all exclusions from GAAP earnings are bad and can help investors get a better sense of the underlying business trends, investors should be aware what charges are not making the cut. Losses from an accident or a natural disaster are the typical exclusions most would understand. However, if a company consistently restructures operations but excludes the associated costs, are these really one off events? Now is a good time to start monitoring these trends as the gap is getting wider[1]:

- Are companies reporting EPS (earnings per share) or EBBS (earnings before the bad stuff)? Companies that provide pro forma earnings may be obscuring worrisome trends in their business by excluding important costs. Many technology companies, for example, will exclude the cost of stock options and other perks paid to employees. This can show up later in stock performance, especially for companies with a heavy debt load. In a recent WSJ article, Justin Lahart explains that “across a wide variety of investing styles, companies with big GAAP gaps tend to underperform in the months that follow.”[2]

- What is it worth? If underlying earnings trends are inflated, then so is a stock’s valuation. For the first quarter of 2016, non-GAAP earnings were 28.9% higher than GAAP earnings, according to FactSet Research. If investors are paying for earnings and an anticipated growth trajectory that is mere fantasy, then a stock is more expensive than you think. This becomes even more important when valuations contract or when the bad news finally catches up.

It is important that we avoid seeing the world through rose colored glasses. As the economy grinds along, investors would be well served to instead focus on cash flow and how management teams can maximize it for the benefit of shareholders. Our investing framework focuses on a company’s ability to generate free cash flow and how it will grow over time. That is why the old investing adage, “earnings are an opinion but cash flow is a fact” still rings true in today’s market.

[1] “S&P 500 Earnings: Far Worse than Advertised”. February 24, 2016

http://www.wsj.com/articles/s-p-500-earnings-far-worse-than-advertised-1456344483

[2] “Investing Red Flag: Pro Forma Results and Share-Price Performance” March 24, 2016

http://www.wsj.com/articles/investing-red-flag-pro-forma-results-and-share-price-performance-1458837868