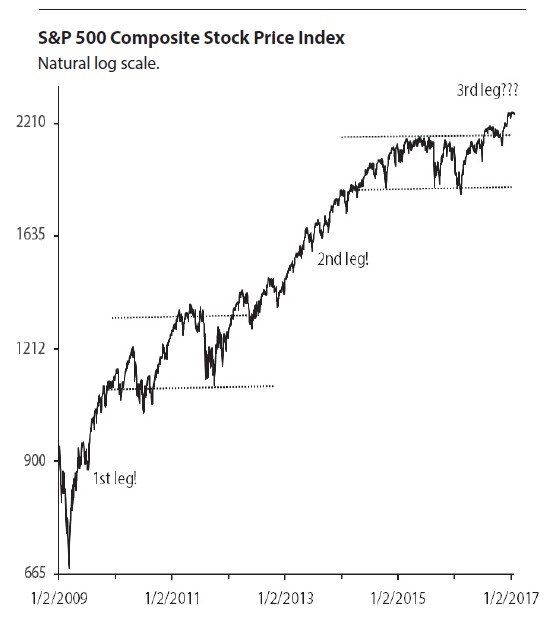

The Equity Bull Market is not Running on Empty

Despite its age, the bull market for equities looks well-positioned to continue, putting it as the second longest in American history. Corporate profits have emerged from a so-called “earnings recession,” consumers are repairing their balance sheets and starting to spend again, and signs of recovery are picking up worldwide. These factors appear to be combining to form a third leg to the current bull market.

The backdrop has become more attractive for equity investors based on the following points.

- The bond bull market is likely over. Interest rates have been moving lower for the last thirty-five years, creating a tailor-made environment for bond investors. The chart below highlights not only the magnitude of the move but also shows how interest rates reached historic lows. The natural direction for rates from today is higher, and we are in the early stages of long-term interest rates returning to conventional levels. As rates move higher, the value of bonds will decrease, likely ending one of the greatest bond bull markets in history.

- Monetary stimulus has ruled capital markets for the last eight years. Now, policy makers appear to be shifting toward fiscal stimulus. There is not much common ground in Washington DC these days, but one thing both political parties agree on is the need to update this country’s infrastructure. While actual proposals may fall short of lofty $1T campaign promises, incremental spending should be positive. Other forms of fiscal stimulus, especially corporate and individual tax reform, if passed, should boost growth and corporate earnings/. It is also interesting to note that this would mark the first time federal policy makers have introduced major fiscal stimulus while the economy is on solid footing.

- Inflation expectations are moving higher. Measures of inflation have been quiet since the Great Recession, while investors have shown more concern over deflation and the next potential crisis. Recent data, however, shows that inflation expectations are slowly creeping higher. Commodity prices are recovering and labor markets have tightened, pushing wages and consumption higher. As a reminder, the consumer makes up 70% of US GDP. The most recent jobs and payroll numbers have provided further evidence of the diminishing risk of deflation. Equities generally perform better in an environment of moderate inflation and act as an inflation hedge, while bonds hedge against deflation.

Taken together, these signs appear to point to a more favorable environment for equities over the medium term. While the risk of a near-term pullback or correction remains, we do not see the conditions forming for the next bear market at this time. Rather, we likely would view a near-term price consolidation as a healthy reset that would allow fundamentals to catch up to valuations.